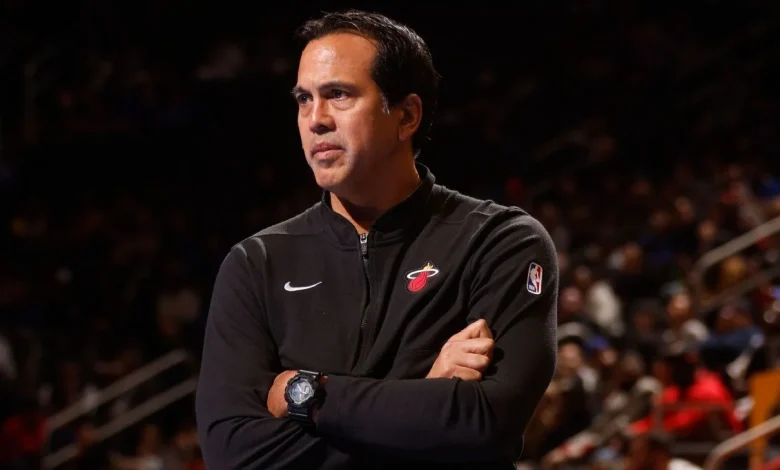

Massive fire heavily damages Spoelstra’s home

CORAL GABLES, Fla. — Fire destroyed a home owned by Miami Heat coach Erik Spoelstra early Thursday, with officials saying more than 20 units were dispatched in what became a futile effort to save the property.

Spoelstra was not home when the fire began, and no injuries were reported. Fire officials said “the home was unoccupied” when the blaze broke out around 4:30 a.m.

An investigation into what caused the fire was starting, officials said. Those probes can take weeks in some cases.

Spoelstra and the Heat played in Denver on Wednesday night and their charter flight back to Miami did not land until 5:11 a.m.

Spoelstra arrived at the home shortly after the plane landed, with several fire crews working to try to contain the blaze. He was seen walking around the outside of the property as the fire continued, sometimes stopping and holding his head in disbelief.

Drone footage captured by CBS affiliate WFOR in Miami showed that, at minimum, much of the home was reduced to charred rubble.

Smoke was still seen rising over parts of the property more than three hours after the first fire trucks arrived, but officials declared the blaze as contained around that time.

Miami-Dade Fire Rescue said the blaze — with flames “as tall as the trees,” battalion chief Victoria Byrd said in a brief news briefing — was fought with crews both on the ground and in the air. The fire was contained to the property owned by Spoelstra and no nearby homes were damaged, Byrd said, adding that a privacy fence and tree cover impeded the initial firefighting efforts.

“Our units came in and did an excellent job,” Byrd said.

Property records show Spoelstra bought the five-bedroom home in December 2023. He had done extensive work to the property following the purchase.

Spoelstra is in his 18th season as head coach of the Heat, an organization he originally joined as a video coordinator in 1995. He finalized a deal last month to serve as coach of the U.S. Olympic men’s basketball team at the 2028 Los Angeles Games.

The Heat were scheduled to be off Thursday and will play host to the Charlotte Hornets on Friday night.