Why some elite investors are turning on the darling of the AI rally

A version of this story appeared in CNN Business’ Nightcap newsletter. To get it in your inbox, sign up for free here.

New York

—

Three prominent investors with almost nothing in common are dumping their shares of Nvidia, the computer chip juggernaut that went from relative obscurity to the world’s first $5 trillion valuation in just three years.

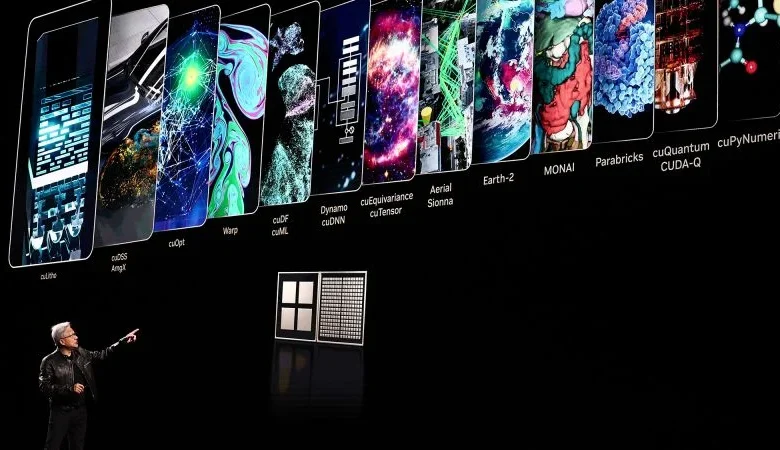

It’s hard to overstate Nvidia’s superlatives. On its own it makes up 8% of the total value of the S&P 500. Its annual net income grew more than 580% between 2023 and 2024. It’s become almost a joke on Wall Street that the company consistently blows past expectations, notching quarter after quarter of financial gains, thanks to seemingly bottomless demand for Nvidia’s sophisticated chips, which are key to building artificial intelligence models like OpenAI’s ChatGPT or Anthropic’s Claude.

So why sell now? Isn’t betting against Nvidia now a bit like betting against the 1995 Bulls? (As in, you’d be out of your mind to do so)?

Maybe not. There are any number of reasons why investors would sell Nvidia, but the timing of these recent moves is fueling concerns that the company — and by extension, the entire AI industry — is part of a speculative bubble that’s bound to burst.

On Monday, a regulatory filing showed tech billionaire Peter Thiel’s hedge fund had, sometime in the three months ending in September, sold its entire stake in Nvidia — all 537,742 shares, which would be worth about $100 million as of September 30, the last day of the quarter. The disclosure, three days ahead of Nvidia’s upcoming earnings release, rattled investors, who are already nervous about when, or whether, they’ll see a return on their AI investments.

Thiel’s revelation came days after Japanese conglomerate SoftBank said it had sold all of its Nvidia holdings for $5.8 billion. And earlier this month, Michael Burry — the “Big Short” investor who anticipated the housing market’s collapse in 2008 — disclosed that his hedge fund had bought more than $1 billion in “put” options against Nvidia and Palantir, another AI darling, essentially wagering that their stocks will fall.

What do Thiel, Burry and SoftBank know about Nvidia that the rest of us don’t? What are they seeing that the rest of Wall Street can’t (or doesn’t want to) see?

To be sure, these folks all had their reasons, and not all of them are directly betting against Nvidia or AI.

SoftBank and its CEO, Masayoshi Son, remain fully aboard the AI hype wagon. But they also needed to gin up a bunch of cash soon to complete a nearly $23 billion investment in OpenAI, prompting them to take their Nvidia profits.

Burry’s position is a much more skeptical one. In a post on X, Burry wrote that he believes Big Tech companies are “understating depreciation” around Nvidia’s core product — essentially, they’ll soon be sitting on a bunch of equipment that’s obsolete, and they’re undervaluing how much that will hurt their bottom line.

Representatives for Thiel, a co-founder of surveillance software giant Palantir and a guy who reportedly believes that strictly regulating AI tech will hasten the arrival of the Antichrist, did not respond to a request for comment. Thiel has previously staked out a fairly conservative position on AI, telling the New York Times’ Ross Douthat that the technology is “more than a nothing burger” but “less than the total transformation of our society.”

The timing of these moves — coming the same quarter that Nvidia hit $5 trillion in market value (it’s now back down to a measly $4.5 trillion) — may be purely coincidental. But they’re not helping soothe any nerves on Wall Street.

“I don’t read a lot into people’s timing with respect to this stuff,” Paul Kedrosky, a partner at SK Ventures, told CNN. “But I do think that there’s been a kind of Gestalt shift in terms of how people think about this entire area and what are reasonable assumptions about future growth.”

Nvidia sank 2% Monday, even as analysts expected the company to once again deliver a solid earnings report on Wednesday. Other tech stocks and crypto followed, dragging the broader market down. Wall Street’s fear gauge, the VIX, jumped 13%. CNN’s Fear and Greed index traded in “extreme fear” and hit its lowest level since early April.

“I think we’re at a tipping point of this bubble,” Mike O’Rourke, chief market atrategist at JonesTrading, told CNN Monday. “And then you have all these other things that were just massively speculative this year,” he added, citing the crypto rally and the expansion of digital asset treasury companies. “Now you’ve seen that very speculative aspect start to unwind, and I wouldn’t be surprised if it bleeds over and people get a little more cautious.”