The sole analyst among 66 to issue a sell rating on NVIDIA stock!

①NVIDIA has recently faced challenges as Japan’s richest man, Masayoshi Son, and billionaire Peter Thiel liquidated their holdings in the company, while analyst Jay Goldberg assigned the stock its only ‘sell’ rating. ②Goldberg believes that the artificial intelligence (AI) cycle is experiencing a bubble, with investment enthusiasm surpassing actual demand, lukewarm corporate adoption, and 95% of companies investing in AI yielding zero returns.

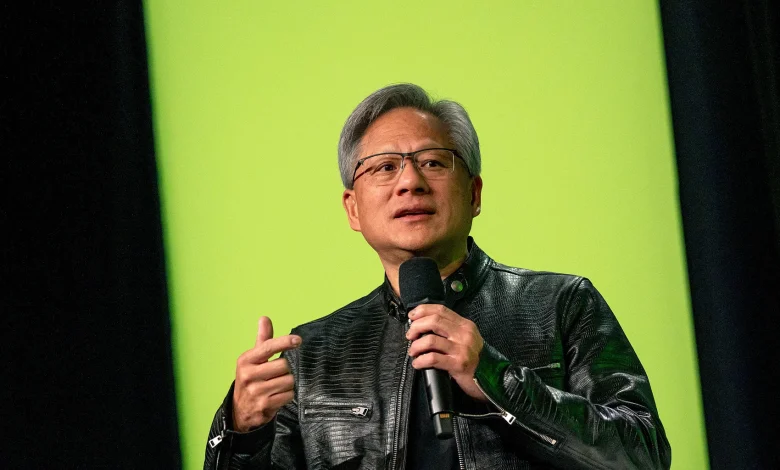

Cailian Press, November 17 (Edited by Huang Junzhi) Amid the current artificial intelligence (AI) boom, NVIDIA, led by Jensen Huang, is undoubtedly the undisputed ‘top influencer.’ However, as voices questioning the existence of an AI bubble grow louder, circumstances appear to be shifting.

Following the move by Japan’s wealthiest individual, Masayoshi Son of SoftBank, to completely divest his NVIDIA shares, documents disclosed last weekend revealed that billionaire Peter Thiel has also sold off his entire stake in NVIDIA. Meanwhile, one analyst has issued the ‘only’ sell rating on NVIDIA’s stock.

Jay Goldberg, a research analyst at Seaport Research Partners—an innovative independent equity research platform—even remarked, ‘It feels great.’ He is the only analyst to assign a ‘sell’ or ‘underperform’ rating to NVIDIA’s stock.

According to FactSet data, among the other 65 surveyed analysts, 60 have assigned a ‘buy’ or ‘outperform’ rating, while five have given a neutral ‘hold’ rating.

A bubble across the entire industry

Goldberg, a former research analyst at Deutsche Bank who also worked in the technology sector, elaborated: ‘I’ve never told my clients to ‘short’ NVIDIA. But I’ve consistently framed my argument as, ‘NVIDIA will underperform the broader industry.’’

He also noted that his analysis is not solely focused on NVIDIA’s stock, but his theory is relevant to anyone investing in the stock market. When the last bubbles burst in 2000 and 2008, it wasn’t just the investments at the center of the frenzy—technology stocks and real estate—that suffered; the entire market fell by 50%.

The market should ideally facilitate transactions between buyers and sellers. If you don’t have sellers, then you’re in trouble. The oldest adage goes, ‘A bubble doesn’t peak until the last bear turns bullish.’ (And based on the situations in 1999-2000 and 2006-2007, a more accurate version might be that it won’t peak until the last bear surrenders.)

“This is complex. I’m increasingly bearish on the AI cycle. I fully agree that it’s a bubble. The semiconductor industry is cyclical. Eventually, the market will return to rationality. This bubble could end in six weeks or it could take three years.” He added.

We have reached a stage where large companies, particularly NVIDIA, OpenAI (the owner of ChatGPT), and others, are providing funding to their own customers. This so-called ‘vendor financing’ was a notorious feature of the internet and tech bubble in the late 1990s and dragged everything down when the bubble burst.

Goldberg noted that as companies issue large amounts of bonds to drive expansion, the situation could become ‘even more frenzied.’ This has already started to happen.

Insufficient demand

Meanwhile, Goldberg further pointed out that the investment frenzy in artificial intelligence, an emerging technology, has exceeded proven end-customer demand.

“I’m particularly nervous about the demand side of AI deals. I don’t think we fully understand the use cases for AI. Corporate adoption has been lukewarm,” he said. A recent study by MIT found that so far, 95% of companies investing in AI have seen ‘zero returns.’

Obsolescence

Goldberg believes that many investors underestimate the costs of operating AI cloud computing server farms, which require substantial electricity. He also stated that AI chips will become obsolete much faster than many industry insiders expect.

“The more important issue is not the physical lifespan of the servers but their economic lifespan,” he said.