Stay disciplined, stay focused

This article first appeared in City & Country, The Edge Malaysia Weekly on November 24, 2025 – November 30, 2025

Despite the ongoing market uncertainties, UEM Sunrise Bhd (KL:UEMS) officer-in-charge and chief financial officer Hafizuddin Sulaiman notes that the company has maintained an optimistic outlook.

“We have been very consistent in our view with regards to the market outlook. With all the measures that have been put in place, such as the [stable] interest rate by Bank Negara Malaysia and Budget 2026, it has been favourable to the industry and for homeowners.”

While his outlook remains optimistic, Hafizuddin stresses the importance of ensuring that the products UEM Sunrise launches align with today’s demand.

“In Johor, we find our landed properties have been performing better because there is an appreciation of our community living and open spaces. So, we try to ensure that we deliver to the market what we think the market will appreciate. We know our homeowners and we want to respect them and give them something that is value accretive.”

In an interview with City & Country, Hafizuddin shares the company’s performance from FY2024 into the first half of FY2025 as well as updates from its developments in the southern region.

At the time of the interview, Hafizuddin was serving as the officer-in-charge. UEM Sunrise has since announced the appointment of Shaharul Farez Hassan as its new managing director and CEO, effective Nov 17.

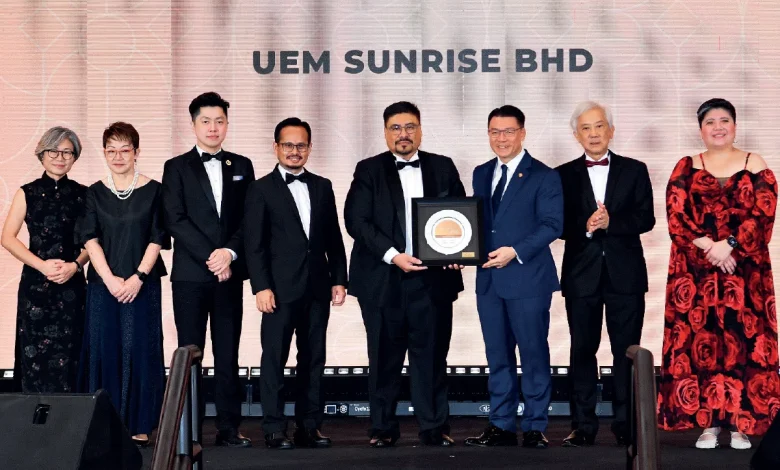

Hafizuddin with (fifth from left) with (from left) The Edge Malaysia editor-in-chief Kathy Fong, editor emeritus Au Foong Yee, ARTELIA director Alex Toh, GSPARX Sdn Bhd managing director Sansubari Che Mud, Housing and Local Government Minister Nga Kor Ming, The Edge Media Group publisher and group CEO Ho Kay Tat and City & Country senior editor E Jacqui Chan (Photo by Mohd Izwan Mohd Nazam/The Edge)

City & Country: Please provide an overview of the group’s financial performance in FY2024 and into FY2025. What are the factors that contributed to the group’s financial performance?

Hafizuddin Sulaiman: FY2024 [ended Dec 31] was a year of recovery for us. Our revenue stood at RM1.3 billion while profit after tax and non-controlling interests (Patanci) increased to RM104.3 million from RM75.7 million in FY2023, reflecting stronger sales conversion and disciplined cost management.

We launched projects with a total gross development value of RM904 million and achieved RM1.4 billion in sales in FY2024, which was supported by market-responsive launches in the southern region. We closed the year with unbilled sales of RM3.04 billion, providing earnings visibility over the next 18 to 36 months. The balance sheet remained resilient, with cash and short-term investments of RM1.2 billion and net gearing improving to 0.4 times, its healthiest level.

Our sales momentum remained firm in 4Q2024, supported by our developments in the central region (The MINH, Residensi ZIG and The Connaught One) and southern region (Aspira Hills, Aspira LakeHomes and Senadi Hills).

Going into FY2025, the first half was very strong for us. Our revenue doubled to RM860.1 million, compared with RM430.2 million in the same period last year. Patanci increased 59% to RM42.9 million, compared with RM27 million in 1H2024.

Property development continues to be our main driver as it contributed 68% of the total revenue. In 1H2025, we launched Allegro in Symphony Hills, Cyberjaya and two phases of Aspira Hills (Phase 2A and 3A) in Gerbang Nusajaya, Johor.

Our unbilled sales stood at RM3 billion, providing earnings visibility over approximately 48 months. Net gearing improved to 0.41 times from 0.43 times in the same period last year while our cash and bank balances increased 11% to RM1.4 billion.

Overall, 1H2025 reflects a meaningful step-up in financial and operating performance compared with 2024. The results demonstrate the resilience of our strategy, disciplined execution and a stronger contribution from property development activities.

What has UEM Sunrise been busy with over the past 12 months?

Our focus has been on strengthening the fundamentals of our development and asset portfolio. We handed over 1,836 units to homeowners of Kaia Heights in Seri Kembangan; Allevia in Mont’ Kiara; Senadi Hills 2A and Aspira Hills in Gerbang Nusajaya in the first half of 2025.

Internationally, we unveiled the display suite of One Oval in Subiaco, Perth, Australia, in July, followed by an official launch in Kuala Lumpur and Singapore. We did two legs in Singapore due to strong interest from Singaporean buyers. We are on track with our development programme for One Oval as we have received bank support for the project and are now in the process of assessing builders.

We continue to activate our assets to strengthen recurring income, including handing over prime retail space at The Beat 2.0 in Kiara Bay, Kuala Lumpur, to Harvey Norman Malaysia.

Overall, our focus has always been centred on disciplined delivery, maintaining our fundamentals, ensuring our developments are on track and making sure our asset portfolio works to our benefit.

We maintain a disciplined, demand-aligned approach in our launches and land activation through strategic partnerships. We remain focused on delivering for our homebuyers and our stakeholders.” — Hafizuddin (Photo by UEM SUNRISE)

With the revised master plan in Gerbang Nusajaya, what new opportunities or partnerships is UEM Sunrise exploring to drive growth there?

There is only one Gerbang Nusajaya. For UEM Sunrise, we want to build it right. Following the revision of our master plan, which is part of our intention to monetise our non-core land, we do see a lot of interest coming into Gerbang Nusajaya, from an industrial standpoint.

Previously, less than 20% of the master plan was dedicated to industrial development. Now, we are increasing it to 28%, driven by the opportunities and growing interest we have received in the industrial space. We expect the revised master plan to be approved within the next 12 months by the Iskandar Puteri City Council (MBIP).

Even our residential developments have been well-received. As mentioned, we launched two phases of Aspira Hills in September and both has since been fully taken up.

We already have the infrastructure and earthworks underway. The Gerbang Nusajaya interchange is expected to open by this year.

We are disciplined in our master planning and activation approach. With the interchange opening soon, there will be greater appreciation for all our programmes within Gerbang Nusajaya.

Furthermore, with the establishment of the Johor-Singapore Special Economic Zone (JS-SEZ), these developments will be beneficial to UEM Sunrise’s long-term growth. Previously, the southern region’s growth was driven by the Iskandar Malaysia agenda. It is now anchored by the JS-SEZ. Therefore, the intention to develop southern Johor has always been there. The difference now is that Singapore is part of the programme.

At UEM Sunrise, we believe in a holistic development approach that complements our residential, industrial and commercial programme aspirations.

An artist’s impression of Allegro. Launched in June 2025, it is a landed residential development in Symphony Hills, Cyberjaya. (Photo by UEM Sunrise)

For the plan to revamp and revitalise Puteri Harbour in Johor, can you give us an update?

Some of the priorities that we have managed to do are to re-establish market relevance and reinforce Puteri Harbour’s positioning as a connected lifestyle waterfront destination. We have seen an increase in footfall, whereby there is greater usability and vibrancy across public areas and commercial spaces. This, we feel, supports the value proposition of our future developments.

We are focused on fostering renewed confidence among the community and stakeholders in Puteri Harbour’s potential. In recent months, we have been doing a lot of placemaking and community activities, such as hosting the Majestic Johor Festival 2024 and the Viper Challenge 2025 which saw strong participation and further elevated the visibility of Puteri Harbour. There is now a greater appreciation among tenants and operators who are looking to set up a base in Puteri Harbour.

We also launched DiReka Square shop office in Puteri Harbour, located opposite the Johor State Complex. Over time, we believe interest in Puteri Harbour will continue to grow.

At the same time, the bus transit system also connects Johor Bahru city centre to Medini and onwards to Gerbang Nusajaya — and it greatly enhances accessibility to Puteri Harbour. We have also rerouted the movement into Puteri Harbour back to the original scheme to improve accessibility. Previously, there was only one way in and out.

There used to be a vibrant hotel, called the Hello Kitty Hotel by Destination Resorts and Hotels Sdn Bhd, which was closed down due to receivership issues and it impacted [the vibrancy of] Puteri Harbour. We are speaking [with relevant partners] to see whether we could take possession of that space and do a total redevelopment.

One Oval is UEM Sunrise’s maiden project in Perth (Photo by UEM Sunrise))

With 2025 marking UEM Sunrise’s shift into the ‘Sustain’ phase of its three-stage plan, what can we expect from the company? How will this fit into its broader U2030 transformation plan?

Our long-term transformation continues and is guided by our Triage, Stabilise and Sustain framework, under the umbrella of our U2030 road map. The initial phase — Triage — was completed in 2023, where we began to see strengthened governance, operational discipline and delivery fundamentals.

As we move into the Stabilise phase (2024-2025), our focus is on strengthening our brand, optimising our portfolio and reinforcing financial resilience. This includes disciplined capital deployment, stronger product positioning and a sharpened focus on understanding the market and segments to maintain our competitive edge.

U2030 integrates and extends these efforts into a long-term road map, ensuring clarity of direction, execution consistency and enterprise resilience. Under this framework, we continue to reinforce internal capabilities, strengthen our partnership ecosystem and align our development pipeline with sustainable, value-accretive growth.

As we transition into the Sustain phase, our priority remains steady delivery; maintaining operational momentum; enhancing customer trust; and creating long-term stakeholder value through disciplined growth and a future-ready organisation.

How does UEM Sunrise ensure the company meets its sustainability goals under its Sustainability Blueprint 2.0?

In our Sustainability Blueprint 2.0, we are committed to achieving carbon neutrality by 2050. While some say 2050 is a long way off, we have set it as a marker. It will be the norm once you embed considerations for environmental, social and governance across our development and operational activities.

We also have our Sustainable Development Design Guidelines, where we ensure every project integrates responsible land use and energy-efficient systems as well as promotes green mobility by providing electric vehicle-ready infrastructure into the products.

Our urban design master plans prioritise walking and cycling. All these are to support liveable and resilient communities. In Publika Shopping Gallery at Mont’ Kiara, we have deployed 249 smart meters for tenants to better manage their energy use. In Johor, we have the 343-acre Sireh Park, where we support biodiversity preservation, environmental and community living with active lifestyles.

What is UEM Sunrise’s long-term vision for property development in Malaysia and how is it planning to adapt to changing market demands?

The property market is evolving, influenced by affordability requirements and lifestyle preferences, with rising demand for sustainable and efficient homes. In response, we continue to prioritise landed and mid-market residential offerings. In the future, we may also introduce build-to-rent, which is typically well accepted in Western countries.

That said, our focus remains on adapting and understanding the types of offerings that best suit our projects within our strategic growth corridors in the central and southern regions. Demand continues to be healthy under the current interest rate environment. We are strengthening our presence in Iskandar Puteri, particularly in Gerbang Nusajaya, supported by the JS-SEZ. The opportunities for logistics and cross-border complementary commercial activities over time are enormous. For example, if we can attract a logistics player to base itself there, the proximity to Singapore offers them [significant cost efficiencies].

Once again, we anchor our efforts to the sustainability agenda by integrating energy-efficient features, green mobility and biodiversity across our developments.

We anticipate demand to remain stable, supported by the government’s continued focus on housing, improving market sentiment and a supportive macro-condition that ensures people have access to financing.

For us, we maintain a disciplined, demand-aligned approach in our launches and land activation through strategic partnerships. We remain focused on delivering for our homebuyers and our stakeholders. This is UEM Sunrise.

Save by subscribing to us for

your print and/or

digital copy.

P/S: The Edge is also available on

Apple’s App Store and

Android’s Google Play.