Mortgage holders brace for Christmas pain as high inflation fuels rate hike fears

Roy Morgan CEO Michele Levine was not surprised by inflation expectations.

ANALYSIS

Mortgage holders are in for a bleak Christmas, after inflation figures came in hot once again in November.

The Consumer Price Index (CPI) rose 3.8 per cent in the 12 months to October 2025, according to the latest release from the Australian Bureau of Statistics (ABS), up from 3.6 per cent in the 12 months to Spetember 2025.

The largest contributors to annual inflation were housing (+5.9 per cent), food and non-alcoholic beverages (+3.2 per cent), and recreation and culture (+3.2 per cent).

The unwinding of electricity rebates, as flagged by Federal Treasurer Jim Chalmers earlier this week, also played a part in the high number, as did recent spikes in the cost of fuel and rising prices for services, including in construction and real estate.

Trimmed mean inflation was 3.3 per cent in the 12 months to October 2025, up from 3.2 per cent in the 12 months to September 2025.

The data has crushed hopes for a December rate cut, and considering Australians are expected to spend nearly $7 billion on one weekend, when Black Friday and Cyber Monday sales kick off in a couple of days, it’s hard to see anything convincing the RBA to change its tack and slash rates.

MORE:The shock real cost of owning a home

In fact, the case for a rate hike is getting stronger by the month.

The recent ANZ-Roy Morgan Inflation Expectations survey hit 5.4 per cent for the week to 23 November, the highest it has been since December 2023.

Roy Morgan CEO Michele Levine was not surprised by the numbers, noting that inflationary pressures driven by energy prices were “clearly a factor”.

“The average retail petrol price is on track to hit an eight-month high above $1.80 per litre in November,” she said.

MORE: Cheap home loans dead as bank axes low rate

Treasurer Jim Chalmers warned of a surge in infation for November. Picture: Nikki Short

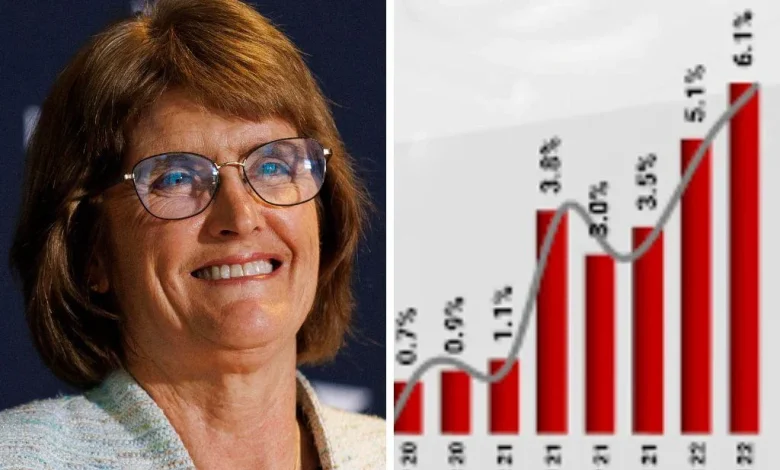

“The rise in inflation expectations, and average retail petrol prices, has been matched by a sustained rise in the official ABS Inflation from a low of 1.9 per cent in June 2025, up to 2.8 per cent in July 2025, 3.0 per cent in August 2025, and 3.5 per cent in September 2025 – the highest since July 2024 (3.5 per cent).

Inflation has begun moving in the wrong direction, it’s still sticky, and Australians continue to spend freely.

MORE: Migration blamed for worsening housing crisis

And with November marking the first month in which the RBA begins to focus on monthly inflation figures, rather than quarterly, thanks to a range of new capabilities allowing the data to consider nearly twice as many measurable factors as before, there is a chance the central bank could be prompted to move in December with a hike.

The Christmas and holiday peak spending season, coming straight after Black Friday sales, could be a reason for a pre-emptive hike to temper spending and prevent the RBA being confronted with even more concerning numbers when it meets again in February 2026.

At its November meeting, the RBA elected to leave rates on hold after three rate cuts this year. Governor Michele Bullock warned inflation was “materially higher than expected” after the September quarter CPI numbers came in at 3.2 per cent.

Trimmed-mean inflation, the RBA’s preferred gauge, had climbed back toward 3 per cent and was forecast to remain there until mid-2026.

“Just below 3 per cent is not good enough for the board,” Ms Bullock said, reaffirming 2.5 per cent as a preferred target figure going forward.

RBA Governor Michele Bullock following the November decision to hold rates. Picture: Nikki Short

“We’ve already had three interest rate cuts. I know that mortgage holders always want more, but it’s also important we keep inflation under control because that’s ultimately what impacts people’s living standards.”

Ms Bullock said keeping the cash rate steady could allow inflation to get back to target sooner.

“If you don’t lower the cash rate from here it gives you a little bit more downward pressure on demand at the margin,” she said. “It might get you to 2.5 per cent a bit more quickly.”

In other words, we’re a long way from target, and getting further away, so mortgage holders brace yourself, because your Christmas bill may be about to get higher.