Beloved Aussie chicken chain El Jannah acquired by US firm in billion-dollar deal

It’s the Aussie success story that started with a single charcoal chicken shop in Sydney’s west and grew into a beloved culinary institution.

Now, El Jannah, the Lebanese chicken chain famous for its garlic sauce, has reportedly been acquired by a New York private equity firm in a blockbuster deal valued at close to $1bn, according to The Financial Review.

The acquisition by General Atlantic – best known in Australia for its investment in aged and disability care platform Mable – signals a major push for the homegrown hero, with ambitious plans to expand its commercial property footprint across the nation and take on fast-food heavyweights like KFC and Red Rooster.

Chief executive Brett Houldin declined to comment on specific transaction details when contacted by The Financial Review on Friday.

“I would say, however, that we’re delighted to have found a partner that is strategically aligned with the Estephan family, management and our franchisees. We’re looking forward to this next chapter in El Jannah’s story.”

RELATED: El Jannah’s bold plan to take over Australia’s fast food scene

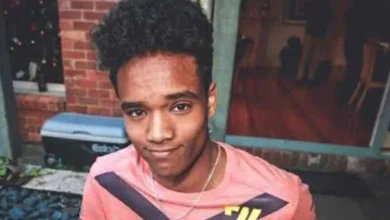

El Jannah CEO Brett Houldin at their new Randwick store. Picture: Jonathan Ng

From humble beginnings to national ambitions

El Jannah’s story is a classic Australian success tale.

Founded in 1998 in Granville, Western Sydney, by Lebanese immigrants Andre and Carole Estephan, the brand started as a humble eatery with a mission to share the flavours of their homeland.

The family were originally in business with Mr Estephan’s sister, Samira, and her husband, Simon Azzi, with another chicken store in Granville called Awafi.

However, the couples soon parted, and the Estephans went on to start their own shop and subsequent fast-food empire.

Today, El Jannah employs over 2000 people, a number Mr Houldin adds continues to grow, making it a significant contributor to local communities.

MORE NEW

$100bn ghost city’s shocking reality exposed

Foreign sites threaten Aus retailers

Dramatic blow for Gen Z’s favourite stationery brand

El Jannah famous charcoal chicken, fattoush salad and tabouleh.

Speaking exclusively to News Corp earlier this year, Mr Houldin also unveiled ambitious plans to expand El Jannah’s footprint across 150 new restaurants across Australia in the next two years, significantly increasing its presence and bringing its unique flavour profile to a wider audience.

Queensland and South Australia are the immediate targets, with multiple sites planned for both states.

At the time, he confirmed El Jannah was actively scouting locations from Noosa to the Queensland border, with Adelaide next in line.

“We expect to be in Queensland with multiple sites in the next 12 months, focusing on southeast Queensland, pretty much from Noosa to the border,” he said.

“With Adelaide, we expect to be there in the next 12 to 18 months. We are just finalising plans there. South Australia is really our next big push.

“Drive-through or shopfront locations are our preferred format, and we have been very successful with the drive-throughs.

“I think they’ve had a real renaissance post-COVID with consumers, so we’re keen to keep growing in that regard.”

A new beginning

While it uncertain how the sale of El Jannah will impact the company future growth plans, the founding Estephan family is understood to retain a substantial stake and remain actively involved, with Houldin also expected to continue as CEO.

This deal marks a significant coup for General Atlantic, which has been actively ramping up its presence in the Australian deal-making scene.

El Jannah founders Andre and Carole Estephan will reportedly stay involved with the business.

Prior to El Jannah, Mable was its sole Australian-headquartered asset, though it has previously backed Authentic Brands Group, which acquired Billabong and Quiksilver parent Boardriders, and luxury fashion brand Zimmermann.

General Atlantic reportedly outbid offers from JPMorgan-advised Goldman Sachs Asset Management and Melbourne buyout firm BGH Capital, advised by Barrenjoey Capital Partners, in the final stages of the auction, as reported by The Financial Review.