When will Progressive customers in Florida get rebates? What you need to know

Florida Gov. Ron DeSantis announces D.O.G.E. audit for Manatee County

Florida Gov. Ron DeSantis announced that Manatee County is next to receive state-level D.O.G.E. budget audits.

This article was updated with more information.

The 2.7 million Florida customers of Progressive Insurance will see about $1 billion in rebate credits in 2026 — but the exact amount each policyholder will receive is still to be decided.

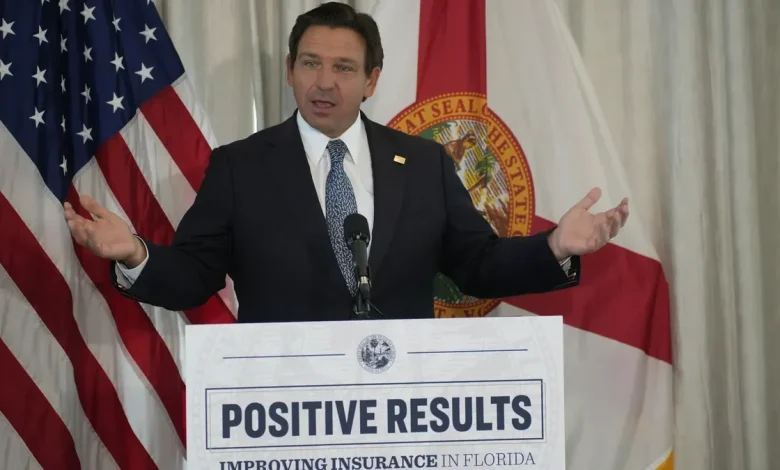

Gov. Ron DeSantis made the announcement during a quick appearance at Sarasota’s Westin Hotel on Oct. 22, joined by Florida Insurance Commissioner Mike Yaworsky, whose office secured the deal with Progressive. DeSantis added that he hoped for similar deals with other auto insurance companies.

“It might be a check; it might be a credit on your bill, but the average across Florida policy holders is going to be a $300 rebate,” the governor said.

Jeff Sibel, a spokesperson with Progressive, told the Herald-Tribune in an email that policyholders should expect to see their account credited in 2026. The amount each customer receives will depend on their “earned premium” in 2025 – the portion of their insurance premium collected by Progressive.

DeSantis estimated that payments would be about $300 a customer, but Progressive has not provided an estimated amount of credit, and said it will vary depending on the policyholder.

“If the eligible policyholder has no balance due, or their credit is greater than their next payment, the remaining credit will be returned via their recent regular payment method,” Sibel said.

How much have auto insurance premiums increased in Florida?

“I know Mike’s going to work with all the other companies to get that statewide, across all our carriers,” DeSantis said. “I don’t think there’s a single carrier where these refunds aren’t going to be triggered.”

After skyrocketing insurance premiums for Floridians in recent years, the governor credited legislative efforts to reform insurance litigation as the reason for a slight decrease in rates.

The Florida Office of Insurance Regulation announced in July that the five major auto insurance companies project a 6.5% rate decrease in 2025. However, that drop is relatively modest compared with the sharp increases that came before — 4.3% in 2024 and 31.7% in 2023.

By those averages, someone who paid a $200 monthly premium in 2022 would now be paying $256.87.

Both DeSantis and Yaworsky credited the news to 2022 and 2023 legal changes aimed at what DeSantis described as “frivolous litigation.” The reforms made it harder for attorneys to collect hefty legal fees in insurance lawsuits.

This move cut much of the incentive for attorneys to take these cases, and the number of lawsuits has dropped dramatically in recent years.

“Florida represented 8% of claims nationwide but accounted for 78% of litigation costs,” DeSantis said. “That’s something policyholders end up paying. It’s basic economics.”

With companies’ litigation costs dropping since these changes were implemented, DeSantis and Yaworsky said the savings are being passed along to consumers.

“We’re seeing rates go down in the auto space at a pace we haven’t seen in decades,” Yaworsky said. “That billion dollars is now going into the pockets of consumers instead of attorneys’ wallets. That’s the bottom line.”

Christian Casale covers local government for the Sarasota Herald-Tribune. Email him at ccasale@gannett.com or christiancasale@protonmail.com. Follow the Herald-Tribune on Instagram

Samantha Neely is a business and trending reporter for the Fort Myers News Press. Email her at sneely@gannett.com