Live: RBA expected to keep interest rates on hold after inflation shock, ASX slips

33m agoMon 3 Nov 2025 at 11:22pm

Market snapshot

- ASX 200: -0.2% to 8,875 points (live updates below)

- Australian dollar: flat at 65.35 US cents

- S&P500: +0.2% to 6,851 points

- Nasdaq: +0.5% to 23,834 points

- FTSE: -0.2% to 9,701 points

- EuroStoxx: +0.1% to 572 points

- Spot gold: -0.2% to $US3,993/ounce

- Brent crude: +0.1% to $US64.84/barrel

- Iron ore: -0.6% to $US105/tonne

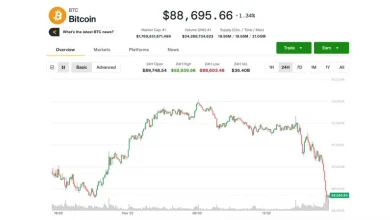

- Bitcoin: -0.4% at $US106,389

Prices current at around 10:20am AEDT

Live updates on the major ASX indices:

12m agoMon 3 Nov 2025 at 11:44pm

Betting on CEO utterances takes financial market insanity to new levels

Most mornings I try to find time to read the Money Stuff newsletter written by Bloomberg columnist Matt Levine.

He’s a genius at finding and dissecting the most ridiculous aspects of Wall Street, financial speculation and corporate shenanigans.

Today, he’s set his sights on a relatively new phenomenon, which is a form of ‘futures trading’ that looks an awful lot like pure gambling.

“Kalshi, a commodities futures exchange registered with the US Commodity Futures Trading Commission, offers contracts on various unconventional commodities like election outcomes and football games,” he observes.

“Last month you could buy futures contracts on commodities like a Coinbase Global Inc. representative saying the words “prediction market” or “Bitcoin” or “Web3” on its third quarter earnings call.

“Why? I don’t know. To hedge your risk that Coinbase wouldn’t say those words? To help people understand and price the future states of the world in which Coinbase did or didn’t say those words? Because you were bored and liked to gamble, probably.”

And guess what happened on Coinbase’s earnings call?

Right near the end, Coinbase CEO Brian Armstrong said:

“I was a little distracted because I was tracking the prediction market about what Coinbase will say on their next earnings call. And I just want to add here the words Bitcoin, Ethereum, Blockchain, staking, and Web3 to make sure we get those in before the end of the call.”

So what’s Matt’s view on this?

“If you and your buddy have a $20 bet on whether or not your boss will say some words in a meeting, and your buddy prods her into saying the words, and she says the words and your buddy wins the bet, I think you would probably be like “ahhh you got me” and hand over the $20. Your buddy would be kind of cheating, but not really. That is the sort of dumb bet that you and your buddy make because you are bored in a meeting and like gambling.”

In short:

“The main point I want to make here is that this is all so dumb and I hate it.”

His take is that increasing swathes of the financial markets have basically morphed into something like sports betting, rather than investments into real businesses or commodities.

Hard to argue with that conclusion.

26m agoMon 3 Nov 2025 at 11:30pm

Top and bottom movers at open

Education (-0.9pc), utilities (-0.6pc) and energy (-0.5pc) stocks are dragging the benchmark index lower at open.

Here are the top and bottom movers in the first half hour of trade.

(LSEG)38m agoMon 3 Nov 2025 at 11:17pm

ASX opens lower

The Australian share market has opened lower in the first 15 minutes of trade.

The ASX 200 index was down 16 points or 0.2% to 8,878, by 10:15am AEDT.

At the same time, the Australian dollar was flat at 65.35 US cents.

1h agoMon 3 Nov 2025 at 10:53pm

Why Michele Bullock is relieved she is keeping rates on hold

Last week, the RBA governor issued a blunt warning on the state of financial markets and as markets continue to shift from traditional valuation methods, plenty of cool heads are getting nervous.

Michele Bullock will endure some tough questions today on why the RBA didn’t see the higher inflation numbers coming.

But she will be secretly counting her blessings that she isn’t cutting rates during a stock-market boom, and with Australian real estate prices in record territory and once again gathering pace.

Read this analysis from chief business correspondent Ian Verrender.

1h agoMon 3 Nov 2025 at 10:28pm

Investors and first home buyers flock to property market

1h agoMon 3 Nov 2025 at 9:57pm

IAG calls for climate action as severe weather drives premiums up

Insurer IAG says Australians should expect rising home premiums, with increasingly frequent and damaging weather events a factor.

An executive from the insurer says climate change will play a rising role in gradually increasing premiums unless urgent action is taken.

Loading…

A new report has found that severe storms, including hailstorms, are predicted to hit the most populated regions in the southern parts of Australia.

Read this article from me and business reporter Yiying Li.

2h agoMon 3 Nov 2025 at 9:28pm

S&P 500, Nasdaq end higher

The S&P 500 and the Nasdaq closed higher on Monday, with artificial intelligence-related deals driving much of the gains, even as the Federal Reserve’s near-term monetary policy grew increasingly foggy due to the scarcity of official US economic data.

Tech and tech-related firms helped boost the Nasdaq to the biggest gain, while healthcare companies UnitedHealth Group and Merck held the Dow in negative territory.

Among the major drivers to the upside, Amazon jumped after the company announced it struck a $US38 billion ($58 billion) deal with OpenAI to allow the ChatGPT maker to run and scale its artificial intelligence workloads on Amazon Web Services’ cloud infrastructure.

Nvidia shares gained after US President Donald Trump said the AI chipmaker’s most advanced microchips will be reserved for US companies and kept out of China and other countries.

Over the weekend, the White House released details about the agreement reached by US President Donald Trump and Chinese President Xi Jinping to de-escalate the trade war between the world’s two biggest economies.

“The Amazon deal and other M&A news have boosted the market, and then you know we came into the week after getting marginally positive news over the weekend, both about the China trade situation and some dovish Fedspeak,” said Ross Mayfield, investment strategy analyst at Baird in Louisville, Kentucky.

“[But] it’s definitely a market led by big tech semiconductors and it has been for almost this entire bull market.”

with Reuters

2h agoMon 3 Nov 2025 at 9:06pm

What the RBA’s next move will be?

HSBC’s chief economist for Australia, Paul Bloxham, has told The Business host Kirsten Aiken that the Reserve Bank of Australia will keep the official cash rate on hold through next year.

He also explains why a hike — eventually — is likely to be the RBA’s next rate move.

Loading…3h agoMon 3 Nov 2025 at 8:38pm

Stock indexes climb after Amazon-OpenAI deal

Most major stock indexes were higher on Monday following news Amazon will supply cloud-computing services to OpenAI, and the US dollar hovered near a three-month high versus the euro due to waning expectations for hefty US rate cuts.

The multi-year $US38 billion ($58 billion) Amazon-OpenAI deal provided some support to equities, with Amazon shares more than 4% higher.

The Federal Reserve last week cut interest rates as expected. But chair Jerome Powell said another cut in December was “not a foregone conclusion”, contrary to some investors’ beliefs that it was essentially a done deal.

Some Fed officials on Friday aired their discomfort with the central bank’s decision to cut rates, even as influential Fed Governor Christopher Waller made the case for more policy easing to shore up a weakening labour market.

Investors have been without most US economic data releases given the ongoing US government shutdown.

“Investors are optimistic about AI and progress with China with respect to the trade truce. But as the market opened, we’re seeing a tale of two tapes,” said Adam Sarhan, chief executive of 50 Park Investments in New York.

“The AI and tech stocks are up today and just about everything else is down. Clearly, the narrowing of leadership continues in a very apparent way,” he said.

The US Supreme Court is considering the legality of President Donald Trump’s global tariffs, with arguments set for Wednesday. Under one legal authority or another, Trump’s tariffs are expected to stay in place long-term.

Tech and tech-related firms helped boost the Nasdaq into the lead, while healthcare companies UnitedHealth Group and Merck were off 3.0% and 3.1%, respectively, dragging the Dow into negative territory.

with Reuters

3h agoMon 3 Nov 2025 at 8:33pm

How has the RBA’s cash rate tracked?

The Reserve Bank’s monetary policy board is forecast to keep the official cash rate unchanged at 3.6% later this afternoon.

So how did we get here?

Here’s how the cash rate has tracked over the past few years:

3h agoMon 3 Nov 2025 at 8:07pm

💬How are you feeling about interest rates?

Whether you’re a home owner with a mortgage, a saver, a renter, a would-be buyer, a retiree or anyone in between, let us know how you’re feeling about interest rates at the moment.

Join the conversation by leaving us a comment above ⬆️

3h agoMon 3 Nov 2025 at 8:03pm

Reserve Bank decision at 2:30pm AEDT

3h agoMon 3 Nov 2025 at 8:02pm

Market snapshot

- ASX 200 futures: -0.2% to 8,889 points

- Australian dollar: -0.1% at 65.37 US cents

- S&P500: +0.1% to 6,850 points

- Nasdaq: +0.4% to 23,824 points

- FTSE: -0.2% to 9,701 points

- EuroStoxx: +0.2% to 598 ponts

- Spot gold: +0.1% to $US4,005/ounce

- Brent crude: +0.1% to $US 64.85/barrel

- Iron ore: -1.3% to $US104.75 a tonne

- Bitcoin: -2.6% at $US107,123

Prices current at around 7:00am AEDT

Live updates on the major ASX indices:

3h agoMon 3 Nov 2025 at 7:58pm

ASX to edge lower

Good morning and welcome to Tuesday’s markets live blog, where we’ll bring you the latest price action and news on the ASX and beyond.

A mixed session on Wall Street overnight sets the tone for local market action today.

The Dow Jones index dropped 0.2 per cent, the S&P 500 gained 0.2 per cent and the Nasdaq Composite up 0.5 per cent.

ASX futures were down 14 points or 0.2 per cent to 8,889 at 7:00am AEDT.

At the same time, the Australian dollar was down 0.1 per cent to 65.40 US cents.

Brent crude oil was up 0.2 per cent, trading at $US64.88 a barrel.

Spot gold advanced 0.1 per cent to $US4,005.19.

Iron ore was down 1.3 per cent to $US104.75 a tonne.