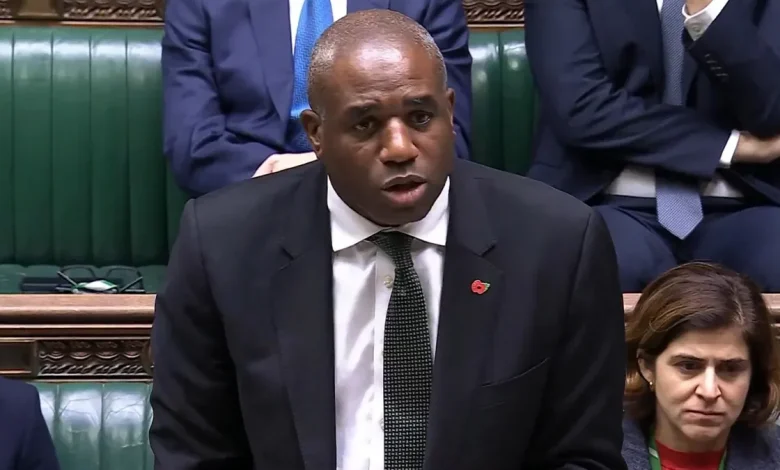

Lammy won’t say if other ‘asylum seeker offenders’ have been mistakenly freed

In our new Pension Diaries series, we will be speaking to people of all ages in the UK to find out how much or how little they have saved for retirement and the realities of putting money aside for your future.

Today, we speak to Judith Howard, 79, who lives alone in Wandsworth, south London, in the house she grew up in with her parents.

How much do you have to live on with your pensions?

I am getting about £950 a month from my state pension and then about £280 a month from my annuity and my total income for the year is about £14,000. But I am still renting a garage to store all my wood for the woodwork which costs £2,000, which only leaves me with £12,000 a year.

From that, I have to pay all my bills, council tax, food and living costs and it is incredibly difficult. My house is so cold and last year, due to them taking away the winter fuel payment, I couldn’t afford to put my heating on so I wore my coat indoors as it was 10 degrees inside. It is a miserable existence.

Caption: Judith Howard, 79, says life has always been a struggle. She deeply regrets deferring her state pension until 75 due to frozen tax thresholds (Photo: Independent Age)

Life has always been a struggle for me – I’m used to that. But I never imagined that by the time I got to being a pensioner, I would be living like a student again, constantly doing calculations in my head about how much I can spend.

What is your biggest pension regret?

I bitterly regret deferring my state pension now as, even though I did benefit from my pension going up by 10.4 per cent a year, the personal tax thresholds didn’t go up so I shot myself in the foot.

It takes me just over the threshold for pension credit, so I can’t benefit from that help, nor can I get help with council tax.

The frozen thresholds also means that I am paying a large amount of income tax on my annuity. I was getting around £350 a month from my annuity, but now I am only getting about £280 a month as the Government is taking all the rest in tax. It feels terribly unfair.

Read the full interview here.