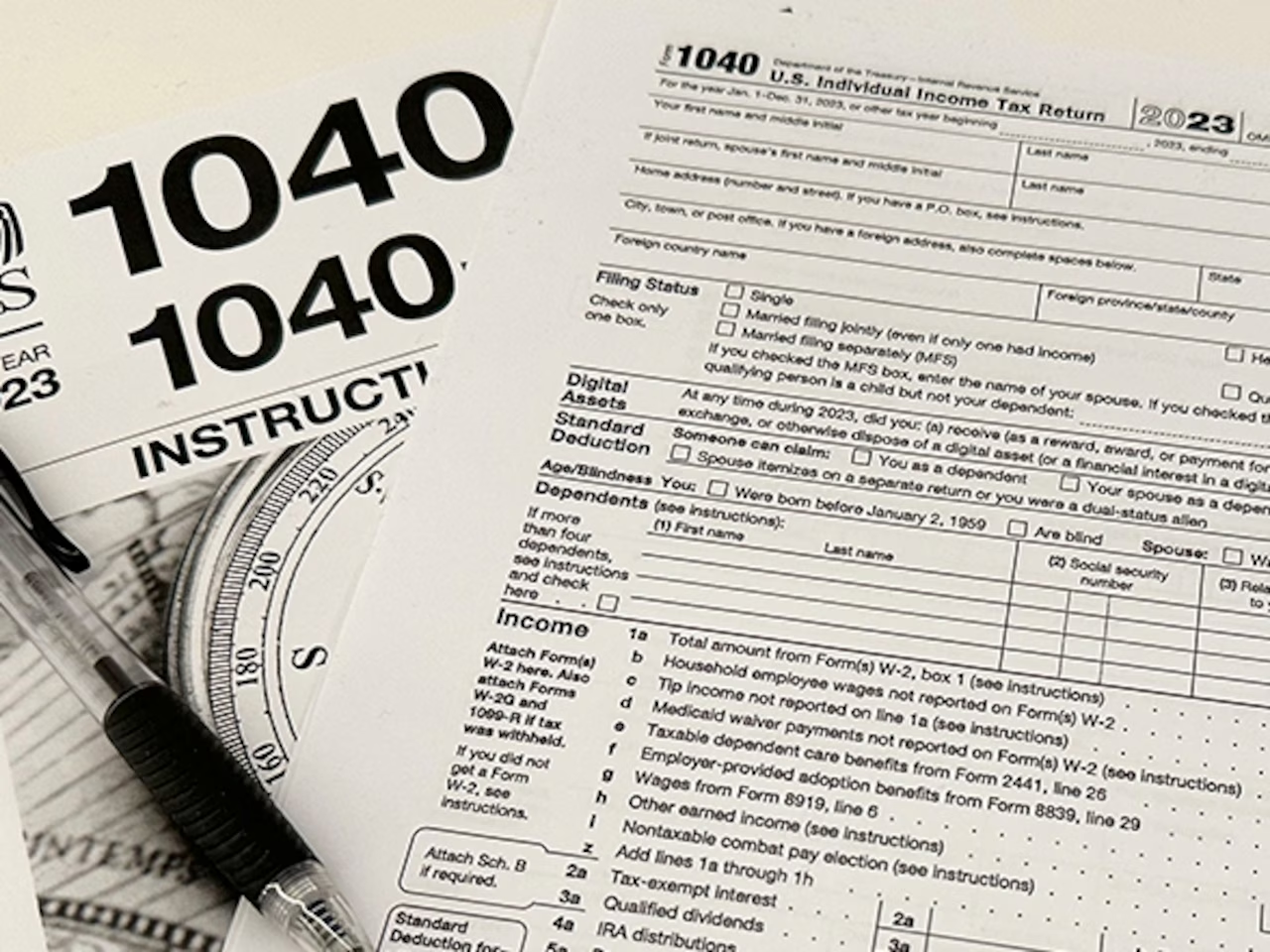

IRS cancels free tax filing program, Oregon senator blasts Trump for hurting taxpayers

The Internal Revenue Service notified Oregon and other states on Monday that the federal government has canceled a free, fledgling tax-filing program — IRS Direct File — that set out to allow millions of Americans to electronically submit their annual federal tax returns for free each April 15.

As news of the cancellation of the Biden-era program began to spread Tuesday and Wednesday, Democratic members of Congress blasted the Trump administration.

Oregon Sen. Ron Wyden said Wednesday that the move will hurt average Americans while benefiting private companies that charge taxpayers to use their software to electronically file.

“The Trump administration operates like a laser-guided weapon aimed at any useful public service that saves Americans time and money,” Wyden said in a news release. “The only thing Trump accomplishes by doing this is stealing from working class taxpayers to pad the profits of giant, rent-seeking tax software companies.”

Massachusetts Sen. Elizabeth Warren said filing “taxes should be free and easy” and that the fight for that will continue.

“Thanks to Donald Trump, giant tax prep companies are popping champagne, while Americans are forced to spend more time and more money to file their taxes,” Warren said in a post on X Wednesday.

According to the U.S. Department of Treasury, taxpayers spend an average of 13 hours and $270 preparing their tax returns each year. The IRS’ free Direct File program was hugely popular, with 90% of respondents in one survey rating the program above average or excellent.

IRS Direct File launched on a pilot basis for tax year 2023, with users in some states (but not Oregon) filing their returns using it in early 2024. It rolled out in all states for tax year 2024, with Oregonians using it for the first time when they filed taxes earlier this year.

The IRS notified states this week that it planned to eliminate the free filing program starting in early 2026, when taxpayers file returns for the 2025 tax year. Monday’s three-paragraph email didn’t say under whose authority the IRS was nixing the program. A spokesperson for Wyden’s office told The Oregonian/OregonLive that remains unclear.

Neither the IRS nor the Department of Treasury responded to requests for comment to The Oregonian/OregonLive on Wednesday.

Oregon taxpayers will still be able to electronically file their state taxes for free through Direct File Oregon, a 2-year-old program that about 14,000 residents used to file their personal income taxes earlier this year. That number is expected to grow, said Robin Maxey, a spokesperson for the Oregon Department of Revenue, though the state had previously linked its free filing program to IRS Direct File.

Maxey said about 4,700 Oregon taxpayers used IRS Direct File to electronically file their federal taxes. That’s a tiny fraction of the estimated 650,000 Oregonians eligible to use it.

“The fact that thousands of Oregonians used the free Direct File service in its first year certainly would leave a fair-minded person to conclude its use would have kept growing in the years ahead,” Wyden said in an email. “Unfortunately and unsurprisingly, Donald Trump killed that future by siding with pricey tax software outfits over taxpayers wanting and needing to save money.”

Republican members of Congress have argued that the federal government has been squandering taxpayer dollars on the current IRS Direct File system because other free programs exist. But the myriad choices make it more difficult for taxpayers to select a program that is right for their needs, and some programs have income or other restrictions on who can use them. Opponents also contend that private companies regularly upsell taxpayers into pricier versions of their tax preparation programs.

Elon Musk, who led the Department of Government Efficiency, also was a big proponent of doing away with the IRS’ free filing system.

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.