Explosive allegations claim fraudster billed JPMorgan for cellulite butter, luxe items as part of $74M legal tab

Charlie Javice, the startup founder convicted of defrauding JPMorgan Chase, stuck the bank with bills for cellulite butter, luxury hotel upgrades and lawyers who claimed to work 24 hours in a single day, according to explosive allegations in court Friday.

JPMorgan has now been forced to pay over $142 million in legal fees for Javice and her co-executive Olivier Amar to fight fraud charges from the feds — nearly as much as the $175 million it shelled out for her bogus startup — due to a judge’s order that the bank is working to get overturned.

JPMorgan, which is on the hook for $74 million in legal fees for Javice alone, says it’s been ripped off again.

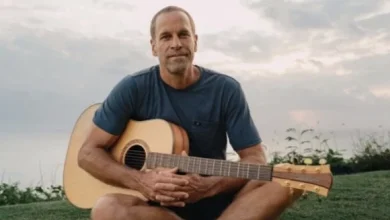

Charlie Javice bill JPMorgan for cellulite butter, luxury hotel upgrades and lawyers who claimed to work 24 hours in a single day, it was alleged. Alec Tabak

“There’s never been a case, to my knowledge, with such extreme abuses,” JPMorgan lawyer Michael Pittinger told a Delaware court, according to The Wall Street Journal.

Along with the cellulite butter, a moisturizer marketed to smooth out skin bumps, Javice’s legal team allegedly billed JPMorgan for additional personal hygiene products, upgraded hotel rooms and meals.

Javice’s lawyers also submitted bills claiming they worked so many hours over several days that it was “humanly impossible for that to have really occurred,” Pittinger said. One attorney allegedly billed 24 hours of work in a single day.

Javice fabricated data to make JPMorgan believe her student financial aid startup Frank had 4.25 million users when it actually had fewer than 300,000, prosecutors said.

She created fake customer lists using data synthesis tools to fool the bank’s due diligence team.

JPMorgan bought Frank for $175 million in 2021.

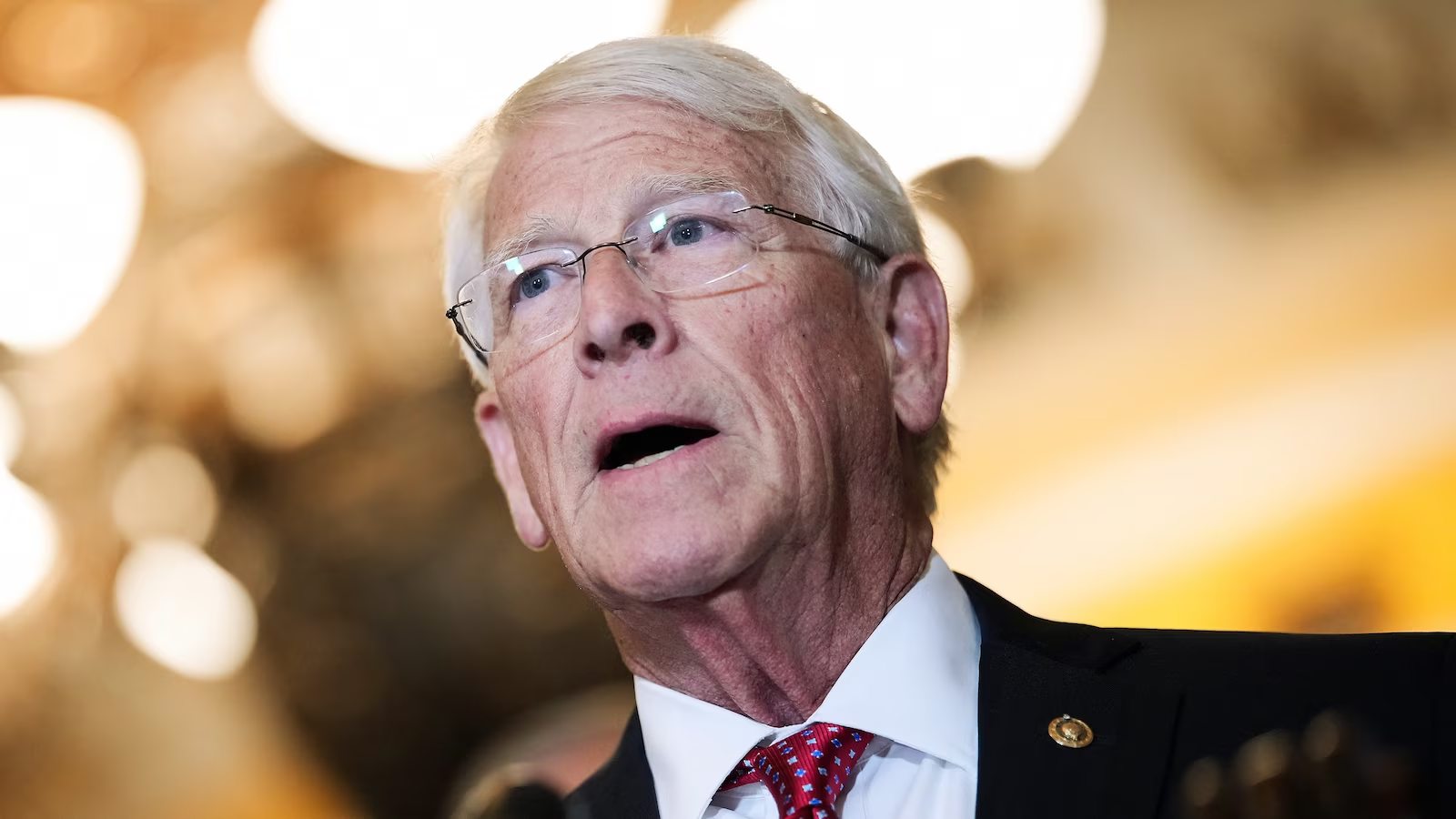

JPMorgan has now been forced to pay $142 million in legal fees for Javice and her co-executive to fight fraud charges. REUTERS

Two years later, Javice was arrested after it became apparent that the fintech startup’s value was based on falsified subscription numbers.

She was convicted in March on four fraud counts in March and sentenced to more than seven years in prison.

Javice continues to bill JPMorgan for legal expenses tied to her appeal of her convictions.

A judge’s order for JPMorgan to front Javice’s legal bills came in 2023. On top of the $74 million tab so far for Javice, the bill for Amar, who was also convicted, is over $68 million.

JPMorgan has accused Javice of “extreme abuses” in its billing of the bank for her legal expenses. REUTERS

Javice’s lawyer Michael Barlow said JPMorgan has dramatically cut payments to her lawyers already — sometimes covering just 10% to 20% of what they billed. That includes slashing fees for Shapiro Arato Bach, the high-profile firm handling her appeal.

“[JPMorgan] massively cut payments because they knew that this was a moment where she was going to be proceeding with an appeal, and that they wanted to essentially dissuade defense counsel from participating,” Barlow said.

Jacob Kirkham, a lawyer for Amar, told the court: “JPMorgan has never been required to pay unreasonable fees.”

He declined to address the specific expenses cited by the bank.

Javice’s lawyers have been billing JPMorgan since 2023, contending that all expenses were “reasonably related” to her defense.

Javice’s lawyers have been billing JPMorgan since 2023, attesting that all expenses were “reasonably related” to her defense. JPMorgan disputes that claim. AFP via Getty Images

Pittinger argued Friday that Javice and Amar are treating the court-ordered fee advancement as a “blank check” because they know they’ll never pay it back.

Both already owe the bank and federal government massive restitution payments that far exceed their wealth.

“They know there’s no way they’re ever paying it back,” Pittinger said.

Delaware Magistrate Christian Wright said he’ll keep hearing arguments, but he’s open to ending the fee advancement entirely if the bank can prove “clear abuse.”

In theory, the bank has the right to recoup the fees if it proves it’s been defrauded. But given what Javice and Amar already owe, that money could be gone for good.

Javice is also fighting a complaint from the Securities and Exchange Commission.

“We continue to believe the legal fees sought by Charlie Javice and Olivier Amar are patently excessive and egregious,” JPMorgan spokesperson Pablo Rodriguez said in a statement.