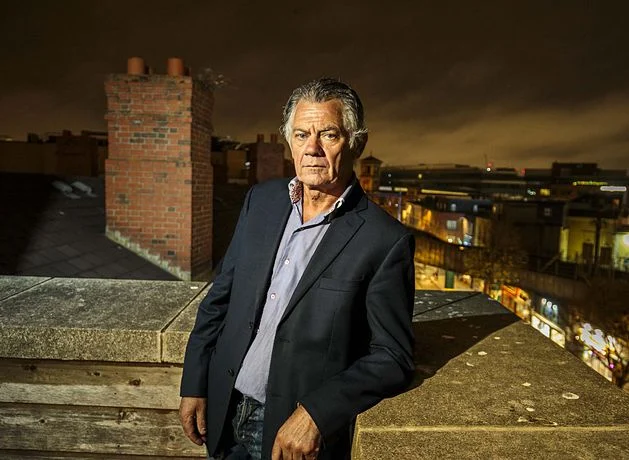

Gerry ‘The Monk’ Hutch hit with €800k bill from CAB after raids on his homes

The demand, which is an unpaid tax bill, came following searches at his properties in Lanzarote and Dublin and his arrest by Spanish police and relates to years between 2006 and 2010.

The Monk was one of the first high-profile criminals to settle a Revenue bill with CAB back in 1999 and later won a court battle to get a taxi licence before pointedly setting up his ‘Carry Any Body’ limo company.

Last year, as he ran for election, he discussed the earlier settlement on the Crime World podcast, but joked that he had a ‘right few bob’ left in his pocket afterwards.

Votes

The Monk has kept a low profile since his failed bid for a seat in the Dáil, when he was pipped at the post by Labour’s Marie Sherlock on transfer votes. He has travelled between Ireland and Lanzarote, where he is resident since 2011.

Hutch almost won a seat in Dáil Éireann

.

The Criminal Assets Bureau is one of the arms of the State which has been central to the Garda crackdown on both the Kinahan and Hutch organised crime groups.

It is a multi-agency body which is made up of officers from An Garda Síochána, the Revenue Commissioners and the Department of Social Protection. It operates as an independent corporate body.

CAB, under its revenue arm, may assess people for unpaid taxes in the State or under Proceeds of Crime cases after assets are identified.

Proceeds of Crime cases usually centre around properties, cars, cash or jewellery that has been seized or identified during investigations.

A home belonging to James ‘Mago’ Gately – who survived a Kinahan assassination and who is a long-time associate of members of the Hutch group – sold this week at auction for €308,000, while a house belonging to Daniel Kinahan sold in December of last year for €930,000.

Gerry Hutch invested in several properties

Ongoing investigations into both the Hutchs and the Kinahans have involved multi-agency co-operation across European forces, with Gardaí at the helm of probes into murder plots, money laundering and corruption.

Hutch was arrested in Lanzarote last October during the high-profile raids, with the assistance from members of An Garda Síochána and CAB who had flown to the island.

Hutch faces a CAB bill for €800k

News in 90 Seconds – 16 November 2025

Campaign

His property in Clontarf was also searched. He was subsequently jailed pending an ongoing investigation into money laundering but was released on €100,000 bail.

Hutch returned to Ireland, where he lodged his papers to stand for election in the north inner-city constituency, managing to run an impressive campaign which saw him almost winning a Dáil seat.

The 62-year-old conducted just one interview over the course of his election campaign, on our Crime World podcast, during which he spoke about surviving Kinahan assassins in Lanzarote on New Year’s Eve 2015 – just two months before the Regency Hotel attack and murder of David Byrne.

Gerry Hutch speaking with Nicola Tallant

Hutch is understood to have amassed a fortune since he settled his original bill with the CAB, investing his money in properties and businesses, some of which are based on the Canary Island of Lanzarote.

He has long insisted that he is a legitimate businessman and even claimed during his podcast interview that he is a victim of the State.

He also said that he settled his original CAB case for ‘miscellaneous income’, saying the Bureau picked him because of his high profile.

Target

“It was a tax bill for miscellaneous income. It is what it is. Everyone is going to get targeted and they like to pick a good target and a big name,” he said at the time.

Gunmen at the Regency Hotel

“If you pick a good target and a big name and that big name settles, everyone else will be queuing up to settle and that is what they were at.

“They just wanted money and they got money. It was seven figures, the magnificent seven.”

Hutch also said that he had property investments and ‘plenty of money.’