Ramp Reaches $32 Billion Valuation, Doubling Revenue and Customers in Past Year

Part of $300M Raise and Employee Tender Offer

NEW YORK, Nov. 17, 2025 /PRNewswire/ — Ramp, the leading financial operations platform, is now valued at $32B following a $300 million primary financing round and an employee tender offer. Lightspeed Venture Partners led the financing, with continued support from existing investors including: Founders Fund, D1 Capital Partners, Coatue, GIC, Avenir Growth, Thrive Capital, Sutter Hill Ventures, T. Rowe Price, Khosla Ventures, ICONIQ, Glade Brook Capital Partners, Soma Capital, Emerson Collective, 8VC, Lux Capital, Definition Capital, 137 Ventures, General Catalyst, Box Group, Kultura Capital, Pinegrove Venture Partners, Anti Fund, and Stripes. New investors in the company include: Alpha Wave Global, Bessemer Venture Partners, Robinhood Ventures, 1789 Capital, Epicenter Capital, and Coral Capital.

There’s a whole new growth curve

To date Ramp has saved customers over $10 billion and 27.5 million hours. These savings come from efficiencies driven within the finance function as well as across companies as a whole. In the past three months alone, Ramp has doubled the percentage of zero-touch transactions for employees — saving massive amounts of time for every individual and function.

In July, Ramp released its first agent: Agents for Controllers. In October, Ramp expanded agentic workflows with Agents for AP.

In October, Ramp’s AI made 26,146,619 decisions across over $10 billion in spend. Customers of every size are experiencing tangible benefits, including:

- Our policy agent prevented 511,157 out-of-policy transactions, saving $290,981,801

- Our treasury agent moved $5.5 million from idle cash to 4% investments

- Our fraud agent blocked a $49,000 AI-generated fake invoice

- Our travel agent saved $113.34 for a customer on his upcoming trip

“I don’t want anyone at Sierra spending time on expense reports or invoices,” said Bret Taylor, Co-Founder and CEO of Sierra and Chairman of OpenAI. “Ramp’s AI has automated entire categories of work that used to slow us down. Because of Ramp, we now have more time to focus on what actually matters, building great products and growing the business.”

Key Company Stats as of Nov 1, 2025

- Generating over $1 billion in annualized revenue and producing free cash flow.

- Serving over 50,000 customers, doubling year-over-year, including CBRE, Shopify, Anduril, Figma, Notion, Cursor, The Chicago Blackhawks, The University of Tennessee, and Vercel.

- Enabling more than $100 billion in annualized purchase volume.*

- Grew enterprise customer base by 133% year-over-year, with over 2,200 customers contributing $100,000 or more in annualized revenue.

- The majority of Ramp’s customers use two or more products across Ramp’s platform.

With this round, Ramp has raised $2.3 billion in total equity financing.

“Our goal is to make every customer more profitable,” said Eric Glyman, co-founder and CEO of Ramp. “On average, companies that switch to Ramp spend 5% less and grow 12% faster – results that outpace nearly every benchmark. The most disciplined and fastest-growing teams choose Ramp because it helps them scale more efficiently. We are working hard to bring that advantage to every business.”

What follows is a letter Eric Glyman, co-founder and CEO of Ramp, shared with customers here.

Ramp at $32 billion: Money talks. Now it thinks.

In the first year of business, every dollar is a decision.

A $500 software subscription is a discussion. A $5,000 research tool is a debate. Everyone knows who approved what — and whether it was worth it.

Ten years later, the same subscription has empty seats renewing on autopilot, and $5,000 of research slips away as miscellaneous. There’s also a $1.2 million SAP maintenance contract that nobody dares question because “it’s always been there.”

You used to run the business. Now the business runs you. And if you do question an expense, you get a spreadsheet, not an answer.

Every founder is adamant this will not happen to them — but it inevitably does. You start building a product. You end up building a bureaucracy.

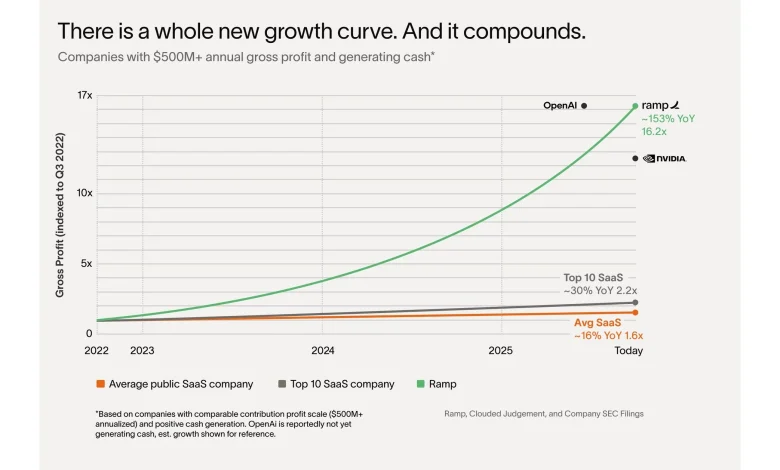

Take the average publicly listed SaaS company. Big teams, lots of bloat. They’re growing at 16% per year. What about just the top 10? The best performers. They’re growing at 30% YoY. This is all public data.1

So when I tell you Ramp’s underlying profitability2 is growing 153% year over year, that sounds absurd. It’s 10x faster each year than the median publicly traded SaaS company. Our revenue was $500 million 12 months ago, over $1 billion today.

A whole new class of companies have come along. Heavyweights that move like lightweights.

Getting big no longer means getting slow. Let me explain.

The Age of “Thinking Money” (2025 —)

For millennia, money talked — but it didn’t think.

Then AI happened. Suddenly, money was no longer just a number in an Excel sheet. For the first time it understood context, could reason, and act.

Imagine a dollar wants to leave your company. Before “thinking money” it could simply walk out. No memory of what it funded, or knowledge if it was spent wisely.

Now, that same dollar has intelligence. So before it leaves it checks for fraud and if you have permission to spend it. It has memory. So as it moves it leaves a complete audit trail and updates budgets. And it can reason. So once it’s spent it tells you if it was well used, underused, or wasted.

That’s one dollar. The average publicly listed SaaS spends over five hundred million of them each year. What if each one a) was only spent if it should be, b) audited itself instantly, and c) flowed only to the highest-impact projects?

You had a bureaucracy. Now, you have a business again.

If money thinks, what does finance do?

Rather than have me explain, let me show you.

In October, Ramp’s AI made 26,146,619 decisions across more than $10 billion in spend. This is “thinking money” with intelligence, memory, and reason. Here are a few of those decisions:

- Our policy agent prevented 511,157 out-of-policy transactions, saving $290,981,801.

- Our treasury agent moved $5.5 million from idle cash to 4% investments.

- Our fraud agent blocked a $49,000 AI-generated fake invoice.

- Our travel agent saved $113.34 for Zain on his trip to New York.

What do all these decisions have in common? They’re objective! Put every accountant in America in a room, give them context and 10 minutes, and they’d all agree. But in practice, thousands of small would-be improvements slip through every day.

Now that all of this is automated, your finance team is free to make a smaller number of higher-leverage decisions. They’re strategists — not clerks. Not catching policy violations, they’re designing policy that enforces itself. Not coding transactions, they’re working out how best to allocate a $500 million budget.

Big decisions. Not the small stuff.

The return of economic productivity

Forty years ago, Robert Solow said “You can see the computer age everywhere but in the productivity statistics.”

And for decades he was right. From 1947 to 1973, U.S. productivity grew 2.8% a year. In the last three decades, just 1.4%. But that was the age of “money talks.”

Now it’s the age of “thinking money.” When thinking money automates the small stuff, companies run better. The median Ramp customer saves 5% while growing revenue 12% year over year.3 They’re closing books in days instead of weeks, running leaner teams, and compounding efficiency gains quarter after quarter.

The promise of the computer age — widely available, cheap intelligence — is only now coming to life, and helping everyday companies get more from their time and money. Finally, we’re proving Solow wrong.

A whole new growth curve

I’d started by telling you “there’s a whole new growth curve.” Well, I’d like to end by explaining it.

All the way back in 1967, there was a computer scientist named Melvin Conway. He was frustrated by how slowly software projects were moving at IBM, so he started researching the problem.

Two months later, he published the paper that introduced the now-infamous Conway’s law.

“Your product mirrors the system of the organization that built it.”

In plain terms: the reason IBM’s software was slow and complicated was because IBM was slow and complicated.

So, what if your staff no longer had to book travel, email receipts, update budgets, or chase approvals? What if there weren’t three layers of management between spend and strategy?

No, you won’t magically start growing at 100% YoY. But you’re building the kind of organization that can.

That’s the second growth curve. That’s “thinking money.”

– Eric

About Ramp

Ramp is a financial operations platform designed to save companies time and money. Our all-in-one solution combines corporate cards and expense management, bill payments, procurement, travel booking, treasury, and automated bookkeeping with built-in intelligence to maximize the impact of every dollar and hour spent. Over 50,000 organizations, from family farms to space startups, have saved $10 billion and 27.5 million hours with Ramp. Founded in 2019, Ramp powers over $100 billion in purchases annually. Learn more at www.ramp.com.

* Ramp does not include bank transfers or non-monetized payments when calculating Total Purchase Volume.

Contact

[email protected]

1 Based on current gross profit growth rates of 1) the top 10 SaaS companies and 2) the average SaaS company within Clouded Judgement’s tracked universe.

2 Ramp’s underlying profitability is measured by contribution profit.

3 Based on anonymized Ramp customer data from Q3 2025, comparing pre- and post-adoption performance across 50,000+ companies. Revenue growth rate is more than double the national average for businesses in the U.S.

SOURCE Ramp