Nvidia shares rise after strong results ease ‘AI bubble’ concerns

The bar was high heading into Nvidia’s results.

Adam Turnquist, chief technical strategist for LPL Financial, said the question was not whether the company would beat expectations, “but by how much”.

Matt Britzman, senior equity analyst at Hargreaves Lansdown, said: “While AI valuations are dominating the news feeds, Nvidia is going about its business in style.”

He said valuations for certain areas of the AI sector “needed to take a breather, but Nvidia is not in that camp”.

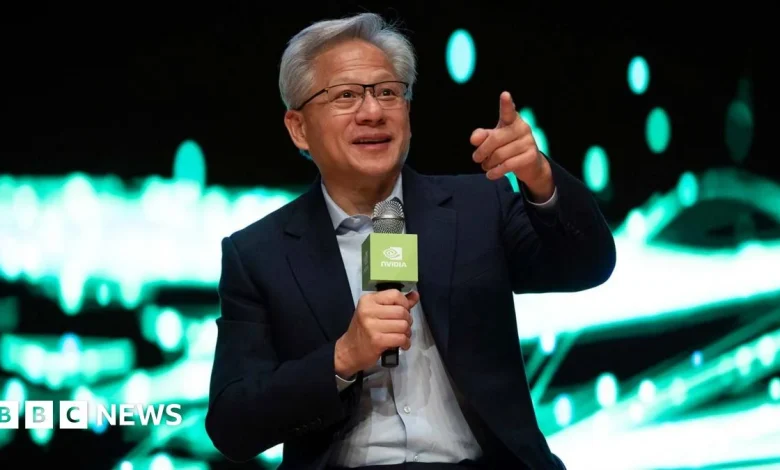

Mr Huang had previously said he expected $500bn in AI chip orders through next year. Investors were looking for details about when the company expects those revenues will come to fruition, and how it plans to fulfill the orders.

Colette Kress, Nvidia’s chief financial officer, told analysts the company would “probably” be taking more orders on top of the $500bn that had already been announced.

But she also expressed disappointment about regulatory limits that stymie the company’s ability to export its chips to China, saying the US “must win the support of every developer” including those in China.

She said Nvidia was “committed to continued engagement” with the American and Chinese governments.

Earlier on Wednesday at the US-Saudi Investment Forum in Washington, Mr Huang joined Elon Musk to announce a massive data centre complex in Saudi Arabia that will have Musk’s AI company, xAI, as its first customer.

The facility will be outfitted with hundreds of thousands of Nvidia chips.

The Wall Street Journal reported the US Commerce Department has approved the sale of up to 70,000 advanced AI chips to state-backed companies in Saudi Arabia and the United Arab Emirates, reversing an earlier decision.

The agreement was brokered following talks between US President Donald Trump and Saudi Arabia’s Crown Prince, Mohammed bin Salman, who visited the White House this week.

![Partnering with Black Forest Labs to bring FLUX.2 [dev] to Workers AI](https://cdn1.emegypt.net/wp-content/uploads/2025/11/Partnering-with-Black-Forest-Labs-to-bring-FLUX2-dev-to-390x220.webp)