Nvidia or AMD: Raymond James Selects the Stronger AI Chip Stock to Buy Now

Is AI a boom or a bubble? That’s the question that investors and market watchers are wrestling with right now.

TipRanks Black Friday Sale

It’s no secret that AI has been driving the bull markets we’ve seen in recent years. In 2025 alone, the tech-oriented NASDAQ index has gained some 17%, and the index’s 3-year gain stands at 100%.

But the tech sector’s high earnings and rapid gains in recent years have fueled worries that we’re in a bubble, and now we’re seeing increased volatility in the stock markets.

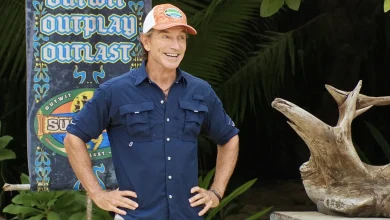

Covering this situation from Raymond James, 5-star analyst Simon Leopold takes the upbeat view that AI is giving markets a boost rather than inflating a bubble.

“We are AI bulls and believe that logic semiconductors will contribute to global secular growth. Recent vendor financing and circular investments among model builders, equipment suppliers, and cloud operators have understandably led to increased skepticism and higher scrutiny around ROI by investors. Comparisons have also been drawn to the dot-com bubble of the late 1990s/early 2000s, but we believe there are several critical differences, especially the business case for AI, and this importantly drives the foundational demand for AI technology and the logic semiconductors that underpin it,” Leopold opined.

It’s a clear conclusion: the AI-powered tech boost is real, and investors can cash in with semiconductor chips. The Raymond James expert goes on to recommend two chip stocks, Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD), as Buys – but he’s clear about which one is the stronger AI chip stock right now. Let’s give his views a closer look.

Nvidia

We’ll start with Nvidia, that chip company that arguably occupies Ground Zero of today’s AI-powered tech boom. Three years ago, Nvidia was uniquely suited to capitalize on the rise of AI; it was known as the inventor of the high-capacity GPU chip, the class of semiconductor that has proven so useful in building out AI-capable systems.

Building on that, Nvidia has seen its sales – and share price – explode. The company’s earnings and revenues have been trending upwards for several years. It brought in $130.5 billion at the top line in its fiscal year 2025, and for the calendar year so far, its stock is up 33%. Nvidia’s market cap of $4.34 trillion makes it the most valuable company on Wall Street, well ahead of second-place Apple.

Nvidia’s success is clearly resting on the AI boom. In his comments on the company’s recently reported third quarter, CEO Jensen Huang stated, “Blackwell sales are off the charts, and cloud GPUs are sold out;” Blackwell, of course, is Nvidia’s latest family of AI-capable chipsets. The company holds a leading role in AI, with a market share in AI chips of approximately 85%, and this is reflected in its quarterly numbers.

Revenue in Nvidia’s fiscal 3Q26 hit $57 billion, a record level, and was up 62% year-over-year, beating forecasts by $1.9 billion. Data center revenue, which is directly tied to the AI and cloud computing markets, was a major driver of the quarterly performance; at $51.2 billion, it made up nearly 90% of the company’s top line and was up 66% year-over-year. At the bottom line, Nvidia posted a non-GAAP EPS of $1.30, up 60% year-over-year and four cents per share above expectations. The company is guiding for as much as $65 billion in revenue for fiscal Q4, which will cover the holiday season.

In his coverage of Nvidia for Raymond James, analyst Leopold writes of its extensive footprint in the AI world and the solid gains that footprint is bringing, saying: “With hundreds of millions of installed GPUs, more than six million developers, and deep integration into enterprise and sovereign AI initiatives worldwide, NVIDIA is uniquely positioned at the center of what it calls the ‘AI industrial revolution,’ where data is the raw material and digital intelligence is the output… We model peak Blackwell sales at 6.9M chips in CY26 vs. the 3M+ NVIDIA will have shipped through October and the 7M it has on order for the remainder of F4Q26 and FY27/CY26. Street estimates appear conservative, and our market model and detailed NVIDIA segment forecasts suggest positive revisions.”

Leopold goes on to note possible limiting factors here, but adds that current conditions are supporting strong gains: “Power constraints and the overall AI cycle are the key risks, and we expect shares to experience at least one outsized drawdown every year or two, but right now the investment cycle appears to be sustaining strong AI investment momentum and shares are reasonable at ~28x NTM P/E.”

All in all, these comments back up Leopold’s Strong Buy rating on NVDA, while his $272 price target implies a one-year upside potential of 53%. (To watch Leopold’s track record, click here)

This view is in accord with the overall market stance on Nvidia. The stock has a Strong Buy rating from the Street’s analysts, based on 41 reviews that include 39 Buys and 1 each for Hold and Sell. The stock is priced at $178.19 and its average price target of $257.72 suggests that the stock will gain ~45% by this time next year. (See NVDA stock forecast)

AMD

While the semiconductor field is currently dominated by Nvidia and its trillion-dollar peers Broadcom and Taiwan Semiconductor, AMD is considered one of the industry’s up-and-coming players. AMD built its earlier reputation for quality products on the back of its PC processor chip business, but over the past six months it has emerged as a challenger in the field of AI-capable semiconductor chips.

Currently, AMD organizes its business into three segments: data center, client and gaming, and embedded. The first of these is directly tied to AI and cloud computing, the second encompasses the company’s PC and gaming chip segments, and the third handles AMD’s industrial applications semiconductors. In its last reported quarter, 3Q25, AMD’s data center business was the largest of the three, bringing in 47% of the company’s revenue.

AMD’s increasing market share in AI chips is evident in the company’s recent announcements of important deals in this area. Earlier this month, the company entered into an agreement to participate in building Alice Recoque, the first exascale supercomputer to be built in France – and only the second in Europe. AMD’s AI and high-performance computing (HPC) chips will form an integral part of the 544-million-euro project.

Last month, AMD announced a strategic partnership with OpenAI, under which AMD will provide the AI development firm with APUs – up to 6 gigawatts’ worth – to power its next generation of infrastructure. The first gigawatt of new chips is scheduled for deployment during the first half of next year.

All of this is part of AMD’s larger strategy, designed to accelerate the company’s next phase of growth. Insatiable demand powered AMD’s 3Q25 financial results, which beat the forecasts at both the top and bottom lines. The company reported $9.25 billion in total revenue, for a 36% year-over-year gain that came in $495 million better than expected, along with non-GAAP earnings of $1.20, 3 cents over the forecast and up 28 cents per share from the prior-year period.

And Raymond James’s Simon Leopold is taking note. The analyst has emphasized AMD’s stream of recent contract wins and remains upbeat about the company’s ability to capture a meaningful slice of the growing AI market.

“Investor skepticism lingers, but shares have attracted a broader audience than in the past and have delivered outstanding performance YTD… Fundamentals need to catch up, and we believe they will. The newest wins with OpenAI and HUMAIN for ~1 GW could be worth $15B in 2026. These grow to over 2 GW in 2027. AMD appears poised for continued server and PC share gains, too. Additionally, the OpenAI deployment may serve as an important endorsement for potentially encouraging other model builders and hyperscalers to adopt AMD GPUs. The AI TAM is large enough to support multiple chip suppliers, and AMD will be among the participants,” Leopold noted.

To this end, Leopold gives AMD shares an Outperform (i.e., Buy) rating, with a $377 price target that points toward a share price gain of 78% over the next 12 months.

Overall, AMD stock boasts a Moderate Buy consensus rating, based on 38 reviews that break down to 28 Buys and 10 Holds. Its trading price of $212.31 and average target price of $284.67 together imply a gain for the year ahead of 34%. (See AMD stock forecast)

With the facts and commentary on the table, the Raymond James analyst may see more upside in AMD – yet he believes that Nvidia remains the stronger contender in the AI race.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Disclaimer & DisclosureReport an Issue