With the recent expansion of volatility in the cryptocurrency market, rumors of a crisis surrounding..

Jingle Research, “MSTR is a financial engineering company” \nBuffit’s ‘Selling put options’, selling volatility to raise capital close to the ‘zero interest rate’\nNew preferred stocks such as preference stocks \nBuilding a ‘permanent capital’ fortress without pressure for repayment\n “Current financial structure has a virtually 0% chance of bankruptcy”

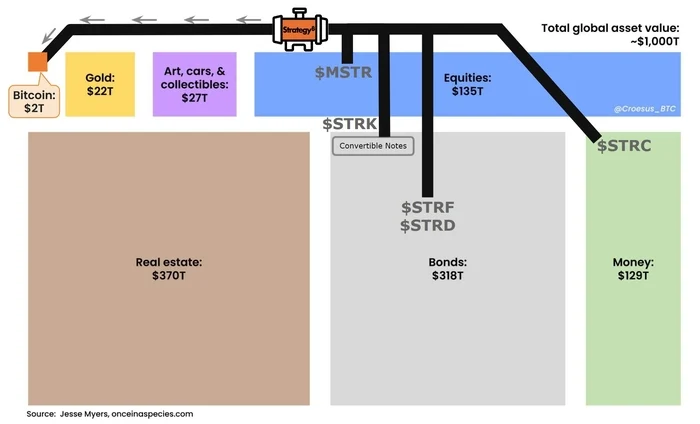

사진 확대 Michael Saylor, chairman of Strategy, likens Bitcoin to a “cyber hornet serving the goddess of wisdom.” The graph below shows that MSTR has raised a total of $21 billion (about W28 trillion) through common stock, preferred stock, and convertible bonds so far in 2025. [Source = X]

With the recent expansion of volatility in the cryptocurrency market, rumors of a crisis surrounding the ‘Bitcoin Whale’ microstrategy (MSTR) are rising.

As MSTR shares are traded at a discount to their net asset value (NAV) or concerns over the failure to incorporate the MSCI index overlap, some are even talking about the possibility of forced liquidation along with Bitcoin Doomsday (Destiny Day).

However, according to a report released by virtual asset data platform Xangle on the 25th, these market fears are close to an “optical illusion” resulting from the failure to understand MSTR’s sophisticated capital structure.

The report analyzed that MSTR has won a financial engineering victory that reversely takes advantage of Bitcoin’s high volatility to dramatically lower the cost of capital, and that the current financial structure is robust enough to actually converge to “0%.”

◆ Benchmark Warren Buffett…”Volatility” to “cash”

사진 확대 MSTR issues convertible bonds (CB) to raise funds at an annual interest rate of 0% and uses them to purchase Bitcoin. Hedge funds recognize CB as a ‘bitcoin call option’ and buy it. The high volatility that occurs in this process is replaced by the capital of MSTR, creating a virtuous cycle structure that strengthens the fundamentals of the company. [Source = Jingle Research]

According to Ziggle, the core of the MSTR strategy is in line with Warren Buffett’s investment philosophy. Just as Buffett took advantage of the market’s downward fears in the mid-2000s to sell put options and pocketed large premiums (cash), MSTR raised funds by selling Bitcoin’s explosive upward expectations (variability) to the market.

Jingle Research explained, “MSTR has artificially created a ‘five-year Bitcoin call option’ that was absent from institutional finance.”

That is the convertible bond (CB) issued by MSTR. Wall Street hedge funds scrambled to buy MSTR’s CB to bet on the Bitcoin bull market, and in return, MSTR was able to raise billions of dollars at ultra-low interest rates ranging from 0% to 1% per year.

Considering the reality that companies with low credit ratings have to pay high interest rates of more than 10%, MSTR has actually borrowed money at “interest-free” using a material called Bitcoin.

◆ The trick that broke through the ‘short selling bottleneck’…Bitcoin-backed perpetual bonds (preferred shares)

사진 확대 Strategy’s Bitcoin sale (yellow dot), which began in August 2020, has continued regardless of price fluctuations. [Source = Strategy]

Of course, there were risks. As CB issuance increased, hedge funds buying it had to short MSTR shares to avoid risk (Delta neutral). This has led to a surge in loan costs and bottlenecks in financing.

As a result, MSTR has taken a new approach this year: issuing ‘preferred stocks’. The lineup, which consists of STRK (including convertible rights), STRF (fixed dividend), and STRC (for retail), is a “permanent bond” character that is accounting capital but has no maturity in practice.

The report analyzed, “Instead of providing investors with a solid fixed annual return of 8-10%, MSTR will monopolize the capital gains from soaring Bitcoin prices.”

Although the procurement rate is higher than CB, it has blocked the risk of bank runs or margin calls by securing “permanent capital” without pressure to repay. This has had the effect of attracting even funds from conservative bond investors into the Bitcoin ecosystem.

◆ According to the number, the safety margin ··”Only 1.46% per year needs to be raised.”

사진 확대 Strategy is absorbing funds from the stock and bond markets through its “Bitcoin pipeline.” Various preferred stocks (STRK, STRF, etc.) and convertible bonds serve as funnels to move capital to Bitcoin market capitalization. [Source = Jesse Myers]

It is pointed out that the “forced liquidation” scenario that the market is concerned about is mathematically less convincing. Currently, the collateral ratio of convertible bonds (maturity of 2028-2032), which are at the top of the MSTR capital structure, is a whopping 6.6 times.

Shin Young-seo, a researcher at Jingle Research, said, “Bitcoin prices have to plunge more than 80% from the current level to create a possibility of default,” adding, “The financial engineering-calculated default probability is 0.00% to 0.11%, which is virtually risk-free assets.”

In particular, the indicator of ‘BTC Breakven ARR’ is the average annual growth rate (BTC Breakven ARR). The Bitcoin growth rate required for MSTR to survive by paying interest and dividends is only 1.46% per year. This means that even if Bitcoin rises below the deposit rate, the MSTR system will run for 68 years without problems.

In the end, Zangle Research explains that the MSTR crisis theory is likely an illusion created by fear of Bitcoin’s short-term volatility.

The MSTR has already moved beyond financing through the issuance of shares, bringing its advanced financing pipeline (21/21 plan) to the completion stage, covering the bond and preferred stock markets.

“MSTR is not vulnerable to bitcoin volatility, but it is ‘oversecured’ enough to absorb the volatility,” Jingle Research said. “It has stronger basic physical strength to withstand a harsh crypto winter than any DAT (digital asset treasure) company.”