What does the future hold for the permanent fund dividend?

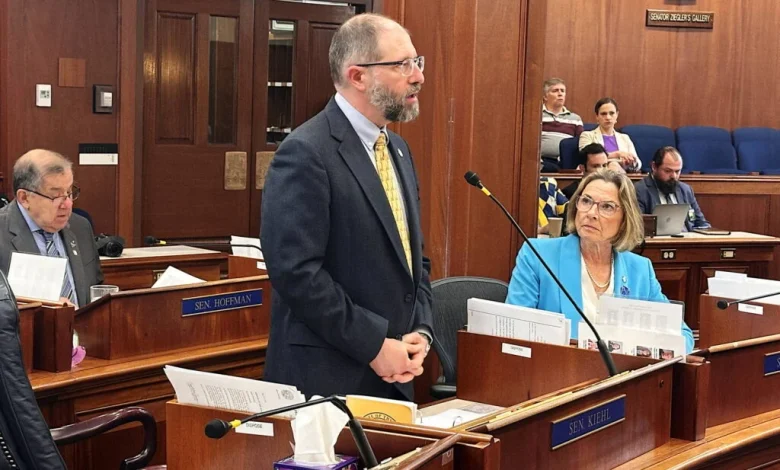

As Alaska braces for another challenging budget season, state Sen. Jesse Kiehl, D-Juneau, is calling for realism in Governor Mike Dunleavy’s soon-to-be-released spending plan.

Speaking at a Juneau Chamber of Commerce luncheon on Oct. 6, Kiehl said that lawmakers are preparing for difficult financial decisions ahead.

Kiehl spoke alongside state Rep. Andi Story, D-Juneau, sharing updates from the Legislature and previewing the upcoming session, which begins in January. The governor’s proposed budget for fiscal year 2027 is expected next month.

Dunleavy’s budget plan for fiscal year 2026 proposed a $3,900 permanent fund dividend per eligible Alaskan. The 10-year projection based on last year’s budget plan shows the state’s current $2.9 billion Constitutional Budget Reserve being $12 billion in debt by 2035.

Kiehl last year said he was disappointed that the governor did not release a more realistic budget proposal, one that wouldn’t need to be drastically rewritten by the Legislature. Last week, he said many legislators doubt that the new plan will be substantially different, but he’s choosing to remain hopeful.

“I’ve heard the phrase, ‘A leopard can’t change its spots’ a couple of times,” Kiehl said. “I choose optimism. We live in Alaska, so I’m hoping we’ve got a ptarmigan that’s gonna change its feathers for the winter.”

Still, Kiehl warned that without a serious fiscal proposal, the state’s payout program could be at risk.

“If the feathers don’t change, and if we don’t get a serious proposal for a fiscal plan that the legislature can then act upon, it’ll be the end of the Permanent Fund dividend check,” he said.

The PFD was created in 1976 to invest a portion of oil revenues for future generations. A portion of the fund has been paid out to Alaskans once yearly since 1982.

The Alaska Permanent Fund is the state’s primary revenue source for its general fund. A 2017 Alaska Supreme Court decision ruled that lawmakers are allowed to use part of those earnings to fund government operations, with the Legislature and governor holding to a 5% withdrawal limit since 2018.

To balance last year’s budget without raising taxes, the state again reduced PFD payments. Last year’s PFD payout was $1,000 per resident, the lowest payment in the program’s 50-year history, accounting for inflation.

Forecasts from last spring projected that oil would sell for an average of $68 per barrel. As of early November, oil was selling for $63 per barrel. Kiehl said that falling oil prices would place more strain on the state’s budget outlook, and that there is no better outlook on the horizon.

“If we continue down the road we’ve been on, with no new revenues, not being able to identify billions in inefficiencies and savings, and trying to use a 40-some-year-old Permanent Fund Dividend formula, the math doesn’t work,” Kiehl said.

To protect the PFD’s longevity, Kiehl said the Legislature needs to rework the formula for allocating the funds and consider a constitutional amendment to prevent future legislatures from overdrawing the from the fund and eroding its value.

“It’s a major part of our economy,” Kiehl said. “It’s part of our politics and culture, too, but I think it serves important purposes.”