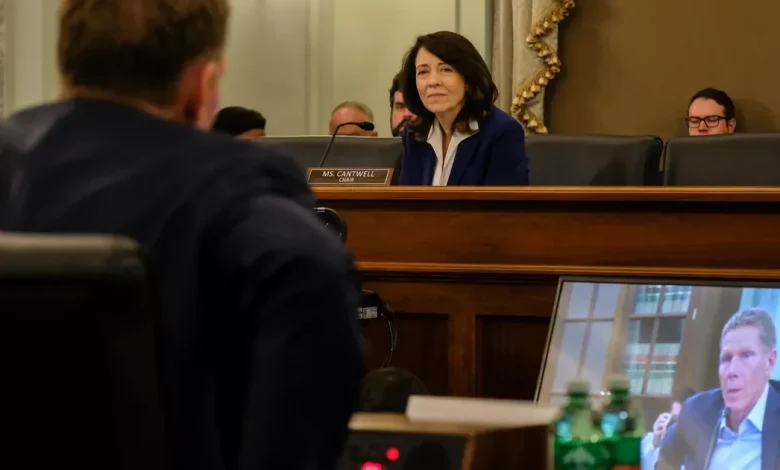

Washington Senator Maria Cantwell has collegiate sports cash in the crosshairs

The deluge of cash pouring into collegiate athletics has Washington’s junior senator inquiring about taxing the school departments, conferences and even coaches at the heart of it all.

In a Monday letter to Congress’ Joint Committee on Taxation, Sen. Maria Cantwell, D-Wash., called for an analysis of the current landscape of college athletics centered around the policies that shield much of the industry from taxation.

The nonpartisan committee dedicated to assisting members of the U.S. House of Representatives and Senate includes a staff of economists, accountants and attorneys, and Cantwell said their expertise will help inform legislation she plans to bring forward.

“Given the evolving market dynamics of college sports coupled with changes in the legal framework affecting college athletes, legitimate questions have been raised about whether it is time to rethink the tax-exempt regime under which college sports currently operates,” Cantwell wrote.

In her request, the 25-year veteran of the Senate inquired directly about many of the banner issues in collegiate athletics, including skyrocketing coaching salaries and related contract buyouts, whether collectives managing name, image and likeness agreements with athletes need specific legislation, and how tax implications would differ for those athletes whether they are classified as employees or independent contractors.

The onslaught of changes appears on track to continue. In recent months, the Big Ten athletic conference has been shopping around the idea of a $2.4 billion private equity deal to its 18 member schools.

That stalled Monday, the day of Cantwell’s letter, with the investment group behind the deal saying it would like to wait for the lone holdouts, the University of Michigan and the University of Southern California, to come on board, as reported by the Mercury News. The decision followed a letter from Cantwell to Big Ten university presidents and chancellors to stress the incongruity in the purpose of a higher education institution and a private equity group.

“This proposed deal with a private equity investor may be counter to your university’s academic goals, may require the sale of university assets to a private investor, and may affect the tax-exempt purpose of those assets,” Cantwell wrote.

UC Investments, part of the University of California’s pension fund, would provide the funding intended to bolster athletic departments spread thin by conference realignment, construction and renovation costs and revenue sharing with athletes.

In exchange, the investment group would receive a 10% stake in Big Ten Enterprises, a company that would be created to manage media rights and sponsorship deals for the league. Schools would receive the funding in a tiered format, with large schools receiving the lion’s share.

Cantwell’s not the only Washington lawmaker to take note of how money is changing college sports. In his first year in office, Rep. Michael Baumgartner, a Spokane Republican, introduced bills aimed at capping exorbitant coaching salaries, establishing a national commission to establish student athlete compensation rules and keeping private equity out.

The latter, introduced in early October, was spurred by the Big Ten deal.

“College sports serve an educational mission – and they’re sustained by billions in annual public subsidies and tax advantages,” Baumgartner said in a news release. “Assets under the control of universities should be managed in service of that public, educational mission – not carved up as a new asset class for private equity, hedge funds, or foreign sovereign wealth funds.”

It doesn’t come as a surprise to sports economist and Smith College professor Andrew Zimbalist that federal lawmakers have their eyes on college sports. Zimbalist, author of 24 books that plumb the business depths of the sports world, said college sports have become “hyper-commercialized.”

“It increasingly looks not like an educational enterprise, but it looks like a business enterprise,” Zimbalist said. “So, of course we should be asking the question about whether it should be treated as a business in terms of the tax privileges.”

The vast majority of America’s higher education institutions, whether private or public, are considered tax-exempt entities under federal law, either due to their status as a government entity, like the public, Washington State University, or their educational mission, like the private, Gonzaga University.

In addition to no profit tax on surpluses generated, colleges and universities also avoid paying the federal, unrelated business income tax, Zimbalist said. That means that private equity deal would result in hundreds of millions in untaxed revenue for the Big Ten member institutions.

Zimbalist said he believes Cantwell is headed in the right direction, and tipped his cap to her as a “leading spokesperson for college athletic reforms.” The taxation discussion will take some work, due to the greatly varied positions athletic departments find themselves in.

The Big Ten and South Eastern Conference, with their resource-rich schools, likely deserve to be taxed, Zimbalist said. It might get a little hairier for the next ring of conferences and schools rounding out what is referred to as the “Power Four,” the Atlantic Coast Conference and the Big 12, and all the smaller conferences and schools to follow.

“You have to look at certain principles you want to establish if there’s going to be a new tax law,” Zimbalist said. “You have to establish what the principles are, and then you leave it up to the IRS to sort through how to apply those principles.”

Legislators will also need to tease out the implications of removing tax-exempt status across college sports, including for women’s and Olympic sports, which are usually funded by the surpluses generated from football and men’s basketball.

“It’s something that has to be looked at carefully, but it certainly needs to be looked at,” Zimbalist said.