Five key takeaways from the UK’s tax-and-spending budget

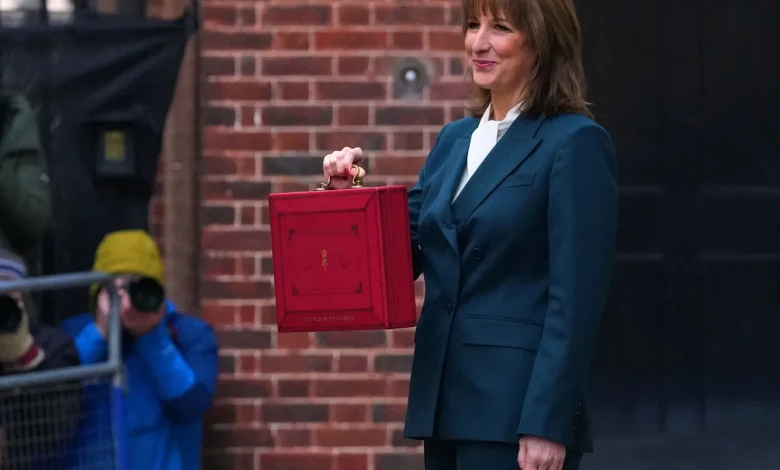

British Chancellor Rachel Reeves announced the latest budget on Wednesday, setting out sweeping tax hikes which are projected to raise 26.1 billion pounds ($34.4bn) for the public purse by 2030.

The budget had been highly anticipated as a “make or break” moment for the UK’s governing Labour party, which has grappled with poor polling over the past year. Earlier this year, an opinion poll by YouGov found that if an election were to be held now, the far-right Reform UK Party, which takes a hard line on immigration, would come to power.

In an embarrassing turn, the country’s Office for Budget Responsibility (OBR) published its economic outlook as a result of the budget on its website two hours before the announcement – something it never normally does until afterwards. Reeves called the blunder “deeply disappointing” and a “serious error”.

Reeves acknowledged that the tax rises – to be paid in large part by freezing existing income tax thresholds, meaning more people will pay higher tax as their incomes rise with inflation – would adversely affect working people. This breaks a key pledge Labour made in its manifesto before last year’s general election.

“We are asking everyone to make a contribution,” Reeves told parliament.

However, she said the tax rises would help pay for nearly 22 billion pounds ($28.9bn) in fiscal headroom within five years. Reeves also said government borrowing would fall each year. Borrowing in 2025-26 is expected to be 138.3bn pounds ($183bn), falling to 112.1 billion pounds ($148.3bn) the year after and to 67.2 billion pounds ($88.9bn) by 2031.

While the UK’s budget deficit is forecast at 28.8 billion pounds for the financial year 2026/2027, Reeves said this would move to surplus in 2028 and forecast a 24.6 billion pound ($32.55) surplus for 2030/2031.

That will pay for welfare spending and means there “will be no return to austerity measures”, Reeves said.

“I said there would be no return to austerity, and I meant it. This budget will maintain our investment in our economy and our National Health Service. I said I would cut the cost of living, and I meant it. This budget will bring down inflation and provide immediate relief for families. I said that I would cut debt and borrowing, and I meant it,” Reeves said.

Here are five key takeaways from this budget.

1. Labour broke its promise not to raise taxes for working people

Reeves raised taxes by about 40 billion pounds ($52.6bn) in last year’s budget – the biggest hike in revenue-raising measures in decades – in what she said would be a one-off needed to put the government’s finances on an even keel.

This time around, while she did not increase income tax or National Insurance Contributions for working people, she did extend a freeze on the income thresholds at which tax must be paid.

This means that more people will be dragged into higher tax brackets as their income rises with inflation. The move will pull 780,000 more people into paying basic-rate income tax for the first time by the 2029-2030 fiscal year along with 920,000 more higher-rate taxpayers and 4,000 additional-rate payers.

“This ‘fiscal drag’ means that hundreds of thousands will start paying income tax for the first time, and all existing taxpayers will face higher liabilities,” Irem Guceri, associate professor of economics and public policy at Oxford University’s Blavatnik School of Government, said.

The previous Conservative government had already frozen these thresholds until 2028. Reeves, who was highly critical of that action at the time – saying it hurt working people – now plans to extend that to 2031.

“I know that maintaining these thresholds is a decision that will affect working people,” she said. “I said that last year, and I won’t pretend otherwise now.”

“I can confirm that I will not be increasing National Insurance, the basic, higher or additional rates of income tax or VAT [value added tax]”, the chancellor added.

Reeves said she will also target wealthier people via a “mansion tax” on those who own property worth more than 2 million pounds ($2.65m) and is reducing the amount of tax relief some higher earners can obtain on pension contributions. She also announced a 2 percentage point increase in tax rates on rental income, dividends and capital gains.

Nigel Green, chief executive of the financial advice firm DeVere, said these moves will have wider “behavioural impacts”. “People make long-term decisions about where to work, where to build wealth and where to retire,” he said.

“When rules around pensions tighten sharply, it undermines confidence in the broader system. Wealth moves where governments show stability over decades, not sudden extractions,” he added.

Following the announcement, Kemi Badenoch, leader of the opposition Conservative party, described Reeves decision to raise taxes, despite promising not to do so again, as “a total humiliation”.

2. Labour will spend money on welfare

One of the highly anticipated announcements of the budget was the scrapping of the two-child benefit cap from April 2026. Currently, parents can only claim special tax credits worth about 3,455 pounds ($4,571) per child for their first two children. The cap was imposed by the previous Conservative government. Reeves said this would lift thousands of children out of poverty.

“The removal of the two-child limit in child benefit is likely to provide significant support to families currently living in poverty,” Guceri said.

Experts said the move would appeal strongly to Labour Party backbenchers. “The two-child benefit cap is widely despised among rebellious Labour MPs as a major contributor to child poverty,” said Colm Murphy, senior lecturer in British politics at Queen Mary University, London. “Repeal was critical for Reeves to have any chance of political survival.”

Gregory Thwaites, research director at Resolution Foundation (RF), a British think tank that focuses on improving living standards, also said the move was a positive step towards reducing child poverty in the UK.

“That’s something that we’ve been campaigning for RF for some time, and we’re very pleased to see that. And then there are some welcome reforms to the tax system, as well. So, for example, charging the people who own very expensive properties a bit more money that will, that’s very welcome, as well,” Thwaites told Al Jazeera.

“Ultimately, budgetary responsibility should not just be seen in terms of fiscal balance but also measures of broader wellbeing,” said professor Jasper Kenter, professorial research fellow at Aberystwyth Business School. “Lifting the two-child benefit cap is important in this regard.”

GMB workers’ union General Secretary Gary Smith welcomed Reeves’s decision to tax wealth and to increase welfare spending, calling this budget the “final nail in the coffin for the Conservatives’ failed austerity project”.

“Key public services, essential national infrastructure, and communities across the UK suffered deep wounds because the Tories made the wrong economic choices – we must never go back to those dark days,” a statement from Smith read.

“The challenge for Labour is to grip the task of rebuilding our economy and country, lock in essential investment to create growth, and start bringing a bit of hope to people,” the statement added.

3. UK’s hated ‘rape clause’ will be scrapped

Reeves said she would scrap the so-called “rape clause”, which exempts women from the two-child benefit cap policy if they can prove their child was conceived non-consensually.

She described the exemption requirement as “vile, grotesque, dehumanising, cruel”.

“I’m proud to be Britain’s first female chancellor,” Reeves told parliament. “I take the responsibilities that come with that seriously. I will not tolerate the grotesque indignity to women of the rape clause any longer.”

4. Slower-than-expected economic growth forecast

In response to the budget, the OBR upgraded its forecast for economic growth for this year from 1 percent to 1.5 percent.

However, it downgraded economic growth for the following four years. GDP growth in 2026 is now expected to be 1.4 percent (down from 1.9 percent), while the OBR has downgraded its forecast for each of 2027, 2028 and 2029 to 1.5 percent (down from approximately 1.8 percent).

Much of the downgrade stems from lower expectations for productivity growth. Reeves insisted the sluggish outlook was the legacy of the previous Conservative government, however.

Reeves also announced a freeze on fuel duty and rail fares, as well as support with energy bills, causing the OBR to revise inflation down by 0.4 percentage points for next year, Guceri said. However, the OBR revised up its forecast for this year to 3.5 percent, “reflecting stronger real wage growth and persistent food price pressures”, she added.

5. The pound and financial markets responded positively

Sterling rose by 0.3 percent against the dollar to $1.3213 just in advance of the budget announcement, before settling back to roughly where it started by the end of it.

London’s blue-chip FTSE index and the FTSE 250 index rose by about 0.6 percent each in the wake of the budget.

“So far, markets showed little reaction to the Budget – something the Chancellor will view as a success,” Guceri said.