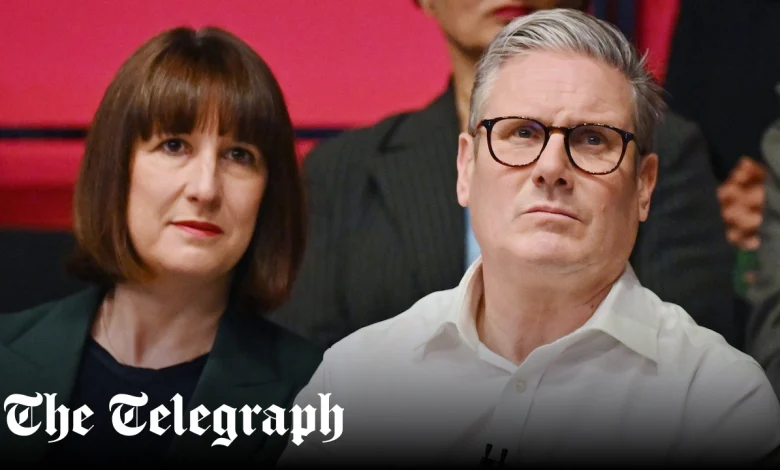

Homeowners face £140k death tax bills ‘by the back door’ under Labour property raid

In her Budget, Ms Reeves launched her latest attack on homeowners, introducing a so-called “mansion tax” – a levy on properties worth £2m or more.

The annual charge will be split into four price bands, rising from £2,500 for a property valued between £2m and £2.5m, rising to £7,500 for a property worth £5m or more.

The charge will come into force in April 2028 and will rise each year in line with the Consumer Prices Index (CPI), a measure of inflation.

It will be collected alongside existing council tax bills by local authorities, with the revenue going to central government.

Ms Reeves is expected to allow people to defer paying the new tax until they move house or after they die amid concerns that some homeowners could be forced to sell their homes to cover the cost.

It means some families will be hit with another layer of inheritance tax when their loved ones die, on top of the existing 40pc death duty.