Exec ‘departs’ over shock Christmas party pic

An executive has departed National Australia Bank’s online offshoot, Ubank, following allegations of a “highly disturbing” incident at a staff Christmas party last month.

Details of the incident, which took place at the function at The Ivy in Sydney’s CBD on Tuesday, November 18, were reported to The Aussie Corporate by an unnamed employee.

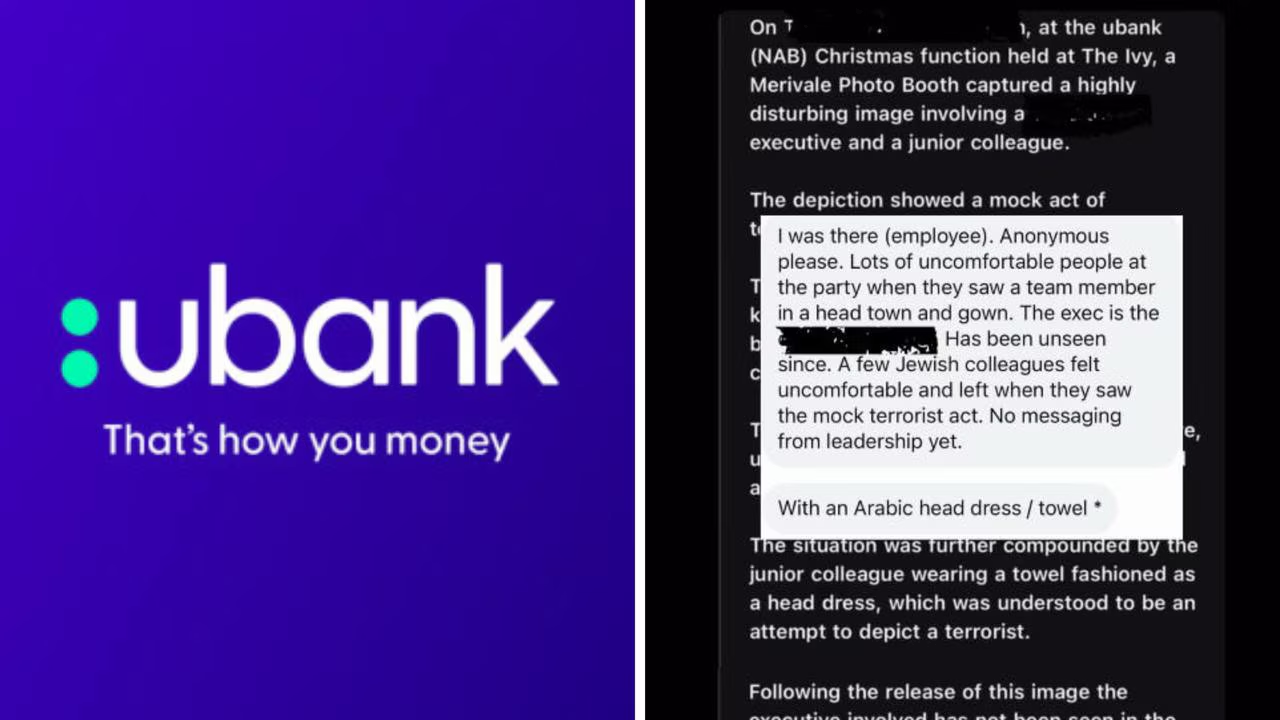

According to the staffer, a photo booth at the Merivale-owned venue “captured a highly disturbing image involving a (redacted) and a junior colleague” posing in “a mock act of terrorism/hostage-taking”.

“The (redacted) was photographed kneeling upright, hands placed behind their back, suggesting they were a hostage or captive,” the employee alleged.

“The junior colleague stood over the executive, using both hands to form gun signs directed at the (redacted).”

Know more? Email natalie.brown@news.com.au

MORE: How to avoid trouble at this year’s Christmas party

The staffer wrote that “the situation was further compounded by the junior colleague wearing a towel fashioned as a head dress, which was understood to be an attempt to depict a terrorist”.

“Following the release of this image the (redacted) involved has not been seen in the workplace,” they continued.

“ubank has failed to acknowledge the incident yet (it) is now common knowledge amongst the staff.”

There were “lots of uncomfortable people at the party when they saw a team member … with an Arabic head dress/towel”, the employee added.

“A few Jewish colleagues felt uncomfortable and left when they saw the mock terrorist act.”

In a statement to news.com.au, Ubank CEO Kanishka Raja confirmed there was “executive departure” on Monday this week related to the Christmas party incident.

“Senior leaders are expected to model appropriate behaviour consistent with our policies,” Mr Raja said.

“We take matters relating to our Code of Conduct extremely seriously.

“We have investigated thoroughly and acted swiftly.”

Ubank was created in a merger of NAB’s digital banking operation by the same name, founded in 2008, and rival Cuscal’s former online retail banking player 86 400, after it was picked up in a $220 million deal in 2021.

The digital banking division is a small but increasingly popular arm of NAB, which is understood to operate largely independently of its heavyweight parent.

Ubank is led by Mr Raja, who took on the running in March after former boss Phillipa Watson left alongside nine other executives.

These include chief customer and digital officer Andrew Morrison, chief lending officer Ray Jokhan, chief information officer Robert Webb, and Chief risk officer Chris Fantan.

Alongside them are chief people officer Sarah Babich, chief financial officer Stephen Chippendale, chief risk enablement officer Barbara Stanko, chief operating officer Angelo Azar, and chief marketing officer Sascha Hunt.

Ubank executives report up into NAB digital and data boss Pete Steel.

It has grown quickly, adding 200,000 customers in the past year taking it beyond 1 million.

Ubank’s home lending has grown from $13.4 billion in 2024 to $16.4 billion in September this year.

$1.3m exec fired over Christmas party act

The incident comes amid warnings for Aussies to behave themselves at Christmas parties this silly season.

In a seperate incident, a high-flying partner at EY was fired from his $1.3 million role after he propositioned a female colleague at a Christmas party, and was later accused of assault in a Sydney bar.

Leonard Nicita was terminated from his role as a senior partner in the firm’s Transaction Tax team in November 2023, according to a decision from Justice David Mossop in the ACT Supreme Court last month.

The first incident happened at a 2022 Christmas party which had a “Miami Vice” dress-up theme, and resulted in a female partner making a complaint to management, the decision said.

During the party, as Nicita’s managing partner described it, he “made comments to the complainant to the effect that you thought she was beautiful, you wanted to sleep with her and, when the complainant said she was married, you noted that most of your affairs are with married women”.

MORE: How to avoid trouble at this year’s Christmas party

When he was notified of the complaint two weeks later, Nicita said that he “was totally shocked and relayed [to her] my recollection of what occurred, believing it to be innocuous”. In evidence to the court he denied he had said he wanted to sleep with the complainant, but said he had suggested they go out for dinner.

When she had said that she was married, he asked her whether she was happily married.

When she told him that she was, he said, “ah yeah, but you will be surprised since being single that I have probably been with more married women than other single women”.

Nicita’s boss told him he was “very disappointed with his behaviour” and that it was “completely unacceptable from anybody, let alone a partner, let alone a senior partner, let alone a senior partner [who] has just re-joined the Firm”. (Nicita had earlier had a stint at EY from 2013 to 2015.)

The 50-year-old received sanctions including 4 per cent of income ($52,000) being stripped from that year’s pay, and was told he was on his “first and final warning against further instances of inappropriate behaviour”. He was also told to apologise to the complainant.

The next incident happened in August 2023 after Nicita had attended a fundraising function for the Sydney University Rugby Club.

Some colleagues moved on from the club to continue drinking at Dean & Nancy cocktail bar in Wynyard, and Nicita joined them with his girlfriend, the decision said.

Having paid the bill of $2,380.79, which he claimed as an expense from EY, Nicita then discovered his jacket was missing.

While trying to locate his jacket, he got in an altercation with bar staff that led to a charge of common assault.

CCTV footage of the incident, according to the decision, showed Nicita “pushing the bar manager with his hand and then moving forward and bumping him with his chest”.

When his boss became aware of the charge and questioned Nicita three months later, Nicita argued the incident was “innocuous” and the assault was “merely a push”.

The managing partner decided to terminate Nicita’s position for “Just Cause” under the partnership agreement.

Nicita launched legal action against the decision, claiming his boss had breached the partnership agreement and seeking damages for those breaches.

He argued the bar incident “did not involve conduct as a partner of the firm but instead occurred in his private life,” and “at the time of the termination, he had given notice of his retirement from the partnership”.

He also claimed the decision was not made in good faith because his boss could have put him on “garden leave” instead.

In his October decision, Justice Mossop rejected Nicita’s arguments and dismissed the proceedings, ordering him to pay costs to EY.