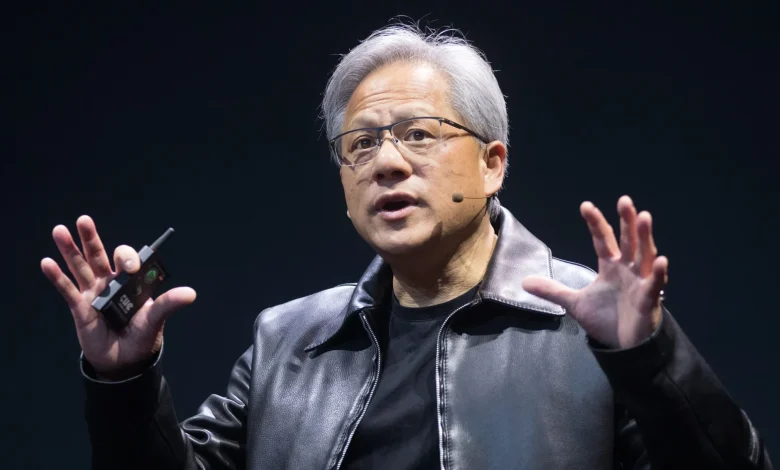

Nvidia (NVDA) Stock: CEO Jensen Huang Cashes Out $1 Billion as Shares Surge 40%

TLDR

- Nvidia CEO Jensen Huang sold 24,990 shares worth $5.19 million on October 29, 2025, at prices between $205.65 and $211.76 per share.

- The sale was part of a pre-arranged Rule 10b5-1 trading plan adopted in March 2025, allowing Huang to sell up to six million shares by year-end.

- Huang has completed over $1 billion in stock sales since June, with shares gaining more than 40% during this period due to AI chip demand.

- Following the recent transaction, Huang directly owns 69.7 million shares and controls hundreds of millions more through trusts and partnerships.

- Nvidia insiders sold nearly $1.5 billion in stock through Q3 2025, with the company reaching a $5 trillion market valuation this week.

Nvidia CEO Jensen Huang sold 24,990 shares of company stock on October 29, 2025, according to SEC filings. The transaction brought in $5.19 million at prices ranging from $205.65 to $211.76 per share.

The sale represents the latest installment in Huang’s ongoing stock liquidation program. He adopted a Rule 10b5-1 trading plan in March 2025 to sell up to six million shares before the end of the year.

NVIDIA Corporation, NVDA

Since June, Huang has offloaded more than $1 billion worth of Nvidia stock. The shares were initially valued at $865 million when sales began in late June. The stock has climbed over 40% since then, pushing the total sale value past the billion-dollar mark.

After the October 29 transaction, Huang directly owns 69,733,203 Nvidia shares. He also controls hundreds of millions of additional shares through various trusts and investment vehicles.

The Jen-Hsun & Lori Huang Living Trust holds 581,378,470 shares. J. and L. Huang Investments holds another 49,489,560 shares. Other holdings are spread across irrevocable trusts and limited liability companies.

Huang currently ranks ninth on the Bloomberg Billionaires Index with a $175.7 billion fortune. He has gained $61.3 billion in wealth this year alone.

The CEO retains a 3.5% stake in Nvidia despite the sales. Since 2001, he has sold more than $2.9 billion of company stock. He has also donated shares worth over $300 million this year to his foundation and a donor-advised fund.

Nvidia Reaches $5 Trillion Valuation

Nvidia became the first company to reach a $5 trillion market value this week. The milestone came just four months after the company crossed the $4 trillion mark.

The stock surge is fueled by demand for artificial intelligence processors. New partnerships announced this week contributed to the latest gains.

The company is scheduled to discuss its third-quarter fiscal 2026 results on November 19. Nvidia recently partnered with Hyundai Motor Group on a $3 billion AI cluster initiative in South Korea. The company also plans to invest up to $1 billion in AI startup Poolside.

Widespread Insider Selling

Huang isn’t alone in cashing out Nvidia shares. Company insiders sold nearly $1.5 billion in stock through the third quarter of 2025. In 2024, Nvidia insiders sold more than $2 billion, up from $462 million in 2023.

Board member Tench Coxe recently joined the world’s 500 richest people with a $7.5 billion net worth. Fellow director Mark Stevens ranks 247th with a $12.5 billion fortune.

The company has created seven billionaires total, including Huang. Board member Brooke Seawell joined the billionaire ranks as the stock climbed in recent days.

Analysts continue to support the stock despite the insider selling activity. Cantor Fitzgerald maintains an Overweight rating with a $300 price target. The firm notes Nvidia trades at about 21 times estimated 2026 earnings per share.

Truist Securities holds a Buy rating with a $228 price target. The firm cited Huang’s recent comments about a large GPU backlog as a positive indicator.

Arista Networks CEO Jayshree Ullal sold $861 million of her company’s stock, ranking behind only Amazon Chairman Jeff Bezos among top company insider sellers across all industries.

Huang’s final sale of 25,000 shares on Friday completed the current phase of his planned stock liquidation program.