Take-Two Interactive: Riding the GTA 6 Wave, But Are the Fundamentals Solid?

Take-Two Interactive Software, Inc. (NASDAQ: TTWO) is currently trading at just over $254 in pre-market hours, up 1.31% in the last five days. The gaming giant is riding a wave of optimism, largely fueled by the impending release of Grand Theft Auto VI (GTA 6). But beneath the surface of hype, are the fundamentals strong enough to justify the current valuation?

The next earnings report, scheduled for today, after market close, will be a critical test for Take-Two. Analysts project an EPS of -$0.62, a notable improvement from the – $2.08 loss posted a year ago, reflecting narrower losses as profitability trends upward. Revenue is expected to reach $1.74 billion, representing a strong 17.7% year-over-year increase.

Markets will be looking for updates on GTA 6 development, as well as insights into the performance of other franchises and the company’s overall financial health. Any surprises in the earnings report could trigger significant volatility in the stock price.

The confirmed release date of GTA 6 on May 26, 2026, has undoubtedly energized the markets. The release of a new trailer earlier this year, garnering over 20 million views in a single day, provided a tangible demonstration of the game’s potential. Rockstar Games, a subsidiary of Take-Two, is under immense pressure to deliver a flawless experience that meets the sky-high expectations. Any slip-ups in development or negative reviews upon release could send shockwaves through TTWO’s stock price.

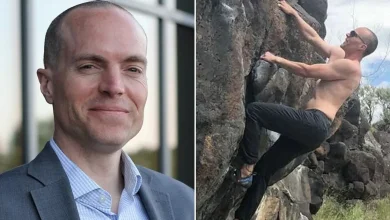

CEO Strauss Zelnick’s comments on GTA 6’s pricing strategy have also been a point of discussion. While the exact price remains undisclosed, Zelnick’s emphasis on delivering value suggests a price point in line with other AAA titles. However, some analysts speculate that Take-Two might push the boundaries of pricing, given the franchise’s immense popularity. A miscalculation here could alienate consumers and impact sales.

Recent financial moves by Take-Two paint a more complex picture than the GTA 6 hype suggests. The company announced a proposed underwritten public offering of $1 billion in common stock back in May. While the proceeds are earmarked for general corporate purposes, including debt repayment and potential acquisitions, the immediate market reaction was negative, with TTWO shares declining by approximately 3% on the news. This reflects market concerns about the potential dilution of existing shares.

Furthermore, Take-Two priced a $600 million senior notes offering in June 2024, using the net proceeds to repay existing debt. While refinancing debt is a common practice, it also highlights the company’s reliance on debt financing. The interest rates on the new notes (5.400% and 5.600%) are notably higher than the previous 3.550% notes, indicating a higher cost of borrowing. This increased interest expense could impact future profitability.

The consensus among analysts is a “Strong Buy” rating for TTWO, with an average price target of $255.05. This suggests only a marginal upside from the current trading price. Firms like Benchmark and Rothschild Redburn have raised their price targets, citing strong financial results and the GTA 6 release date. However, it’s important to remember that analyst ratings are not always accurate and can be influenced by various factors. The herd mentality can often lead to overvaluation, especially in hyped sectors like gaming.

While the market is currently fixated on GTA 6, we believe a more cautious approach is warranted. Let’s play devil’s advocate. The company’s reliance on a single franchise for a significant portion of its revenue is a major risk. If GTA 6 underperforms, the impact on TTWO’s financials could be devastating.

Furthermore, the increasing competition in the gaming industry, particularly from mobile gaming and subscription services, poses a threat to Take-Two’s long-term growth. While the company has seen some success in mobile gaming, it faces stiff competition from established players like Tencent and NetEase.

The shift towards subscription models could also disrupt Take-Two’s traditional revenue streams. The recent stock offering and debt refinancing suggest that Take-Two is preparing for a more challenging environment. Perhaps the funds are not just for GTA 6 but for future acquisitions to diversify holdings. While analysts are bullish, we believe a more balanced view is necessary.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY