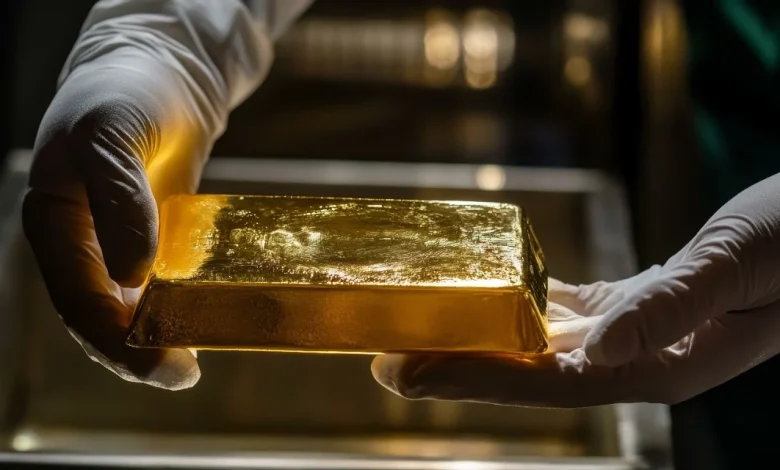

Gold price slides for fourth straight session as traders await Nvidia earnings and US jobs data

Risk reduction drives market sentiment

Gold is trading lower at $4031 (-0.35%) on Tuesday, 18 November on course for a fourth consecutive session of declines after shedding more than 4.5% from last week’s high of $4245.

A perfect storm of bearish pressures is weighing on the precious metal.

Broad-based risk reduction has swept through equities, credit, foreign exchange (FX) and commodities as investors brace for NVIDIA’s pivotal earnings on Thursday morning AEDT and the critical United States (US) September jobs report early Friday morning AEDT. Lingering concerns over private credit exposures have only added to the tone of risk reduction.

This widespread deleveraging has fuelled a rebound in the US dollar, which traditionally exerts heavy downward pressure on non-yielding bullion.

Fed signals and policy expectations weigh on gold

Gold’s slide began in earnest last week after hawkish remarks from several Federal Reserve (Fed) officials prompted markets to slash the probability of a 25 basis point (bp) rate cut from the Fed in December from around 68% to just 40%, eroding gold’s appeal as a zero-yield asset.

Influential Fed governor Christopher Waller pushed back overnight against recent hawkish Fed speak, warning of labour market ‘stall speed’ risks and endorsing a December easing from the Fed as prudent risk management. Yet his dovish comments have so far failed to halt the decline.

Finally, the reopening of the US government following October’s longest-ever shutdown has also removed a key tailwind that propelled gold to all-time highs in early October.

Gold remains strong despite near-term pain

Despite the near-term pain, gold is still up a remarkable 53.72% year-to-date, on track for its strongest annual performance since 1979. Relentless central bank buying and robust investor demand for protection against soaring fiscal deficits and persistent geopolitical uncertainty continue to provide a powerful macro backdrop to any corrective pullbacks.

Gold technical analysis

Gold’s decline from its record $4381 high of 21 October is viewed as a correction, not a reversal lower.

At this point, it appears that gold has completed the first two legs of a correction (waves A and B) but is missing another leg lower (wave C), which should take it below the 28 October $3886 low to complete the correction.

The wave equality target for the third leg is around $3750. Pending signs of a basing in the $3750 area, traders might consider positioning for a rally anticipating a retest and break of the $4381 high.