It Sure Looks Like the Trump Admin Is Prepping for SCOTUS To Demolish Its Tariff Policy

President Donald Trump’s foreign trade policy has been marked by contradiction from the beginning of his second term. He says he’s using tariffs to help close the U.S. budget deficit while increasing that deficit by $2.4 trillion with his signature tax cuts and defense spending package. He ran as a populist promising to decrease inflation, but made inflationary tariffs his signature economic policy. He has cited national security threats to justify his emergency tariffs, but then applied sharp levies to Brazilian grocery goods after the country convicted and sentenced its former president, a Trump ally, to prison time for an attempted self-coup.

That topsy-turvy approach was on full display during last month’s oral arguments before the Supreme Court, when the administration’s top attorney assured justices that Trump’s tariffs were regulatory, not revenue raising, despite Trump’s claims that tariffs made the U.S. into “a rich nation” and his allies publicly lauding the billions of dollars collected in tariff revenue. Justices sounded deeply skeptical, and, soon after, Trump announced a flurry of modifications to his tariffs on certain foreign imports levied using the International Emergency Economic Powers Act (IEEPA). At the same time, the administration continued stacking up tariffs on more specific goods under a different statute.

Whether those pivots are more about SCOTUS’ likely, imminent decision overturning Trump’s emergency tariffs, or about addressing affordability for voters, depends on who you ask. At the same time, Trump administration officials are now openly sharing their plans to work around an unfavorable SCOTUS decision by transferring IEEPA tariffs to other statutes.

In late November, Bloomberg cited anonymous administration officials to report that the Trump administration was analyzing ways to replace IEEPA tariffs with other statutes, including Section 301 and Section 122 of the Trade Act, which provide unilateral presidential tariffing authority but with more limits. Section 122 only allows a 15% tariff for 150 days, for example.

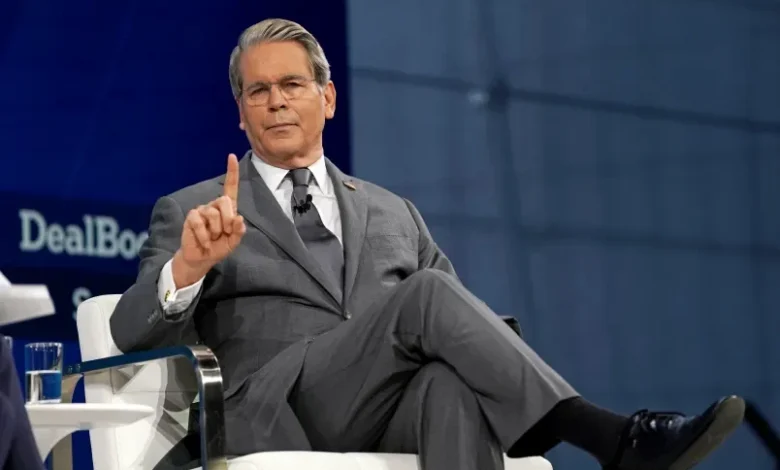

Treasury Secretary Scott Bessent on Wednesday said the administration would increase its reliance on the already-in-use Section 232 tariff statute in the event of a losing SCOTUS decision.

“We can re-create the exact tariff structure with 301s, with 232s, with the — I think — a 122,” Bessent reportedly said during the New York Times DealBook Summit Wednesday.

The White House did not respond to a request for comment.

Reached via email, a spokesperson for U.S. Customs and Border Protection, which helps regulate foreign commerce, said the agency does not comment on pending litigation.

“CBP continues to implement and enforce tariffs as directed by Executive Order and Proclamation,” the spokesperson said.

Since oral arguments on Nov. 5, Trump has removed or otherwise modified IEEPA tariffs for myriad goods imported from at least seven countries. Coffee and beef from Brazil, pharmaceutical products, aerospace equipment, and key commodities from Malaysia, and textiles and apparel from El Salvador are all coming into the U.S. at a 0% tariff, for instance.

It appears Trump is rushing to close deals in case the administration’s tariffs leverage is taken off the table by the Supreme Court, Inu Manak, senior fellow for international trade at the Council on Foreign Relations, told TPM.

“We’ve seen a focus on the conclusion of negotiations that were sort of started because of the imposition of tariffs,” said Manak. “And I think part of the reason for that has been the fear that if the tariffs go away, that there’s gonna be no incentive for each country to sit down and negotiate with the United States.”

Manak noted Trump’s trade deal frameworks have evolved over the course of his term, from detail-free, two-page documents to more specific policy-centered commitments that benefit the U.S. That evolution reflects a “choose your own adventure” kind of foreign trade policy strategy from the administration, where, through individual negotiations, officials have been gradually learning what they can extract from trading partners, Manak said.

Since the beginning of November, the administration has also applied product-specific tariffs on imports including medium and heavy-duty trucks and buses under Section 232. Those shifts weren’t so much to hedge against a negative Supreme Court decision as to broker deal frameworks with trading partners and tackle affordability issues, Alex Durante, senior economist at the right-leaning Tax Foundation, told TPM.

“I think this was sort of always something that he was intending to do,” said Durante about Trump, “which is, impose the tariffs and then see if we can extract certain concessions and then in exchange for that, we’ll lower some of the duties we’re imposing on them.”

Durante said he doesn’t believe Trump will ever want a “zero-tariff world” but is using the drastic levies as a negotiating tool for trading partners. In return for commitments to purchase more U.S. products and invest in the country, the administration will modify — though usually not eliminate — tariffs on a nation’s imports. In that way, the administration’s contradictory approach to this trade mechanism persists, said Durante.

“That’s been the general theme for a lot of these deals is that there’s an announcement that so and so is going to purchase X billion dollars of whatever product. And I think when people critically look under the hood, they reach the conclusion that these seem unrealistic based on what we know about those markets,” he said.

During Trump’s first term, for example, China pledged billions in U.S. product purchases during a so-called phase one deal but much of that investment never materialized. From the onset, experts noted China’s commitment exceeded the nation’s demand for U.S. trade.

“So this strategy is clearly not really working out the way that the president has intended,” said Durante.

The Supreme Court usually releases decisions in June, but the tariffs case is on an expedited timeline: international trade law firms expect the Court to issue a decision on this case as soon as this month, or early next year.