Hollywood Blockbuster: Netflix Poised to Win Battle for Warner Bros.

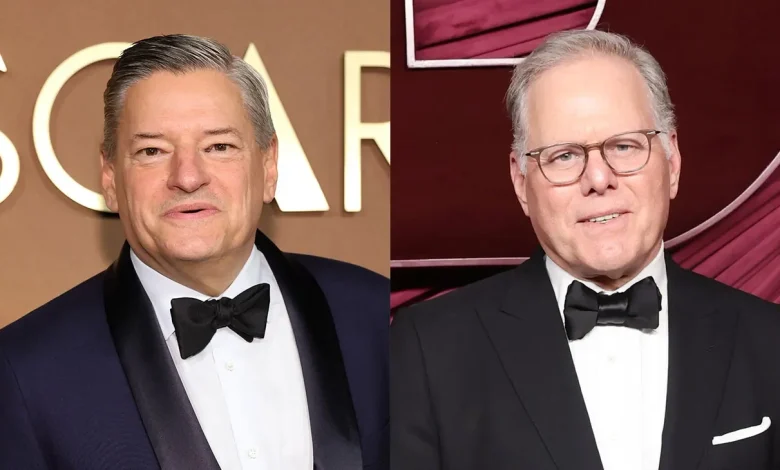

In a deal that would dramatically change the entertainment industry, Netflix, led by Ted Sarandos and Greg Peters, is poised to win the battle for Warner Bros. Discovery‘s studios and HBO Max streaming business.

Netflix has entered into exclusive talks with the David Zaslav-led WBD after topping rival bids from Paramount and Comcast.

There is still a lot that needs to happen for the deal to close, but if it does, it would alter the course of the entertainment industry, with its impact felt across streaming video, theatrical filmmaking and studio production.

Entering into exclusive talks do not necessarily mean that the companies will come to a definitive agreement, and even if they do, they will need to navigate a complex regulatory environment in the U.S. and around the world. Paramount executives believed that their deal would have an easier path to approval than the offer from Netflix, given Netflix’s scale in subscription streaming, but that was not enough to overcome Netflix’s bid.

Specific deal terms were not immediately available, though they were clearly strong enough to warrant moving forward on exclusive talks. CNN reported that Netflix offered $28 per share, with Paramount offering $27, though Paramount was trying to buy the entire company, not just the studios and streaming business.

Bloomberg, which first reported the news, says that Netflix has offered a $5 billion breakup fee should the deal not be allowed to go through, an enormous sum that could offset concerns about regulatory challenges.

If the companies agree on a final deal, they will need to deal with U.S. regulators, with leaks to the New York Post suggesting that the Department of Justice is already planning a legal challenge. European regulators may also be skeptical of the deal. Netflix is likely to argue that the video marketplace is much broader than just subscription streaming, and could point to YouTube’s domination of video viewing as a counterweight to any arguments they make.

Should the deal go through, Netflix would become the steward of one of the industry’s most storied film studios, and one of its most prolific TV studios. The fate of its theatrical releases and its production for other streaming services and TV channels could hang in the balance. And HBO and HBO Max, arguably the most prestigious brand in TV, would become a part of the Netflix portfolio.

The potential addition of such a valued set of entertainment properties to a tech-oriented company had some in Hollywood on edge. At least one traditional studio executive was lamenting the outcome, saying privately Thursday night that they feared that a Netflix takeover of a traditional movie studio would deal a mortal blow to exhibition. The streamer would be unlikely to put WB movies in theaters, they said, causing an already teetering business to topple further.

Studios also rely on revenue from Netflix buying movies for post-theatrical windows, and with the WB library the company would be less likely to do so.

Also in question is the future of a certain kind of of premium TV in a combined company. HBO has long focused on development, with shows taking a longer time to get to air as executives honed and chiseled them, often over years, a process Netflix has not always been known for.

Meanwhile, WBD’s linear TV assets, including CNN, TNT, TBS, HGTV and Food Network, would continue to be spun out into their own company.

There have been signs that things were trending in Netflix’s direction. On Thursday morning, a letter from lawyers for Paramount to Zaslav leaked, calling the process “unfair.”

“Several U.S. media outlets have reported on the enthusiasm by WBD management for a transaction with Netflix, and on statements by management that a transaction between WBD and Netflix would be a ‘slam dunk,’ while also referring to Paramount’s bid in a negative light,” read the Paramount letter. “Additional reporting since the submission of revised bids on December 1 has indicated that WBD’s ‘board has really warmed to’ a transaction with Netflix due to the ‘chemistry between’ WBD management and Netflix management.”

Representatives for WBD and Netflix did not respond to requests for comment.

Steven Zeitchik contributed to this report.