Netflix’s Biggest Wall Street Backer Downgrades It on Warner Bros. Deal

Netflix is widely described on Wall Street as the undisputed winner of the streaming wars. And last week, the company, once derisively compared by a former CEO of Warner Bros. parent Time Warner to the Albanian army, unveiled an $82.7 billion deal to acquire Warner Bros. Discovery’s studios and streaming operations.

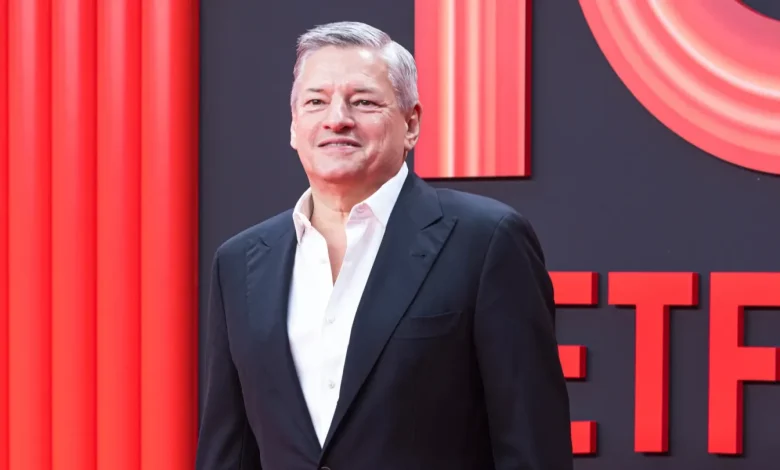

But the big question analysts are asking is if Netflix’s leadership of co-CEOs Ted Sarandos and Greg Peters and chairman Reed Hastings struck the mega-transaction as an opportunistic offensive play or as a defensive move. In other words, does Netflix see Warner Bros. as a rare opportunity to buy a venerable Hollywood studio full of popular franchises — and at the same time keep the likes of Paramount Skydance and Comcast/NBCUniversal from gobbling it up and strengthen its competitive position? Or does Netflix worry about its ability to continue growing audience engagement amid the rise of shortform and creator economy powerhouses, such as YouTube and TikTok?

Wall Street’s biggest Netflix bull pumped the brakes Monday, expressing concern that the latter was the driving force behind the WB deal. Downgrading his rating on Netflix shares from “buy” to “hold” and his stock price target from $160 to $105, Pivotal Research Group analyst Jeff Wlodarczak summarized his take on the mega-transaction in the headline of his report: “An $83B Admission of Long-Form Headwinds.”

The deal for WBD’s studios and streaming assets is “an expensive deal that, assuming the deal is approved by regulators, would appear to cement Netflix’s dominance of long-form premium entertainment globally,” he wrote. “But it introduces: 1) deal approval risk and a likely 18-24 month time frame to close, 2) the possibility of a bidding war with Paramount Skydance driving the price higher and, most importantly, 3) we believe this very expensive deal highlights Netflix management’s concern that short-form entertainment (TikTok, Insta, X, YouTube shorts and Snap) is doing to streaming what streaming has done to traditional TV as (especially younger) consumers spend an increasing amount of time on these free platforms amidst declining attention spans, which is fundamentally negative for long- form content.”

The analyst pointed to the lack of big-dollar takeovers by the streamers in the past as a sign that it has long trusted its ability to execute well and continue growing organically without a need for buying any huge assets. “One can credibly argue Netflix suddenly doing this expensive deal is reflective of (legitimate) concern over a lack of growth in core engagement despite content success, which likely is reflective of declining attention spans and the rise of short-form social media entertainment (TikTok/Insta/YouTube Shorts/X/Snap),” Wlodarczak argued.

The Pivotal Research expert added, “While we still think it is early, time spent by consumers is migrating from traditional multichannel TV to streaming and now to social media platforms. Flat to declining engagement, arguably, is a precursor to subscriber weakness and difficulty taking price, and Netflix is doing an extremely expensive content acquisition deal to at least temporarily offset this, but we believe this trend is likely set in stone.”

Wlodarczak’s takeaway: “We decided, based on the effects of the last point, to take a more conservative stance on our long-term subscriber and average revenue per user (ARPU) forecasts and do not incorporate the Warner deal in our estimates, which will likely cause us to raise our subscriber and ARPU forecasts but at a quite significant cost.”