Europe Coffee Market Size and Forecast 2025–2033

Europe Coffee Market Overview

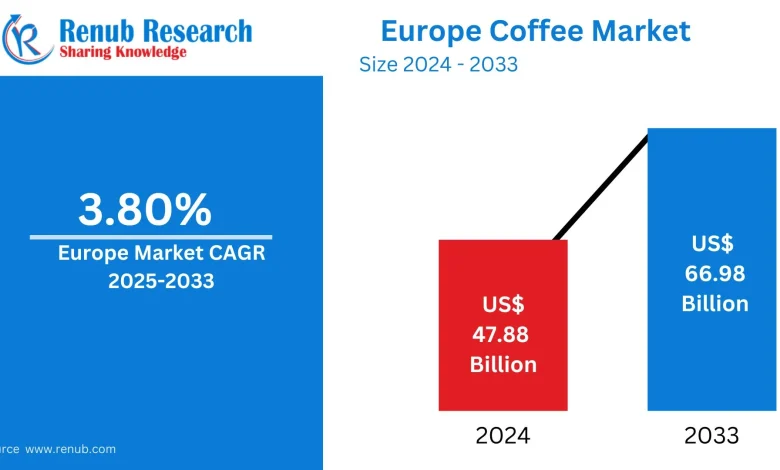

The Europe Coffee Market, valued at USD 47.88 billion in 2024, is projected to reach USD 66.98 billion by 2033, expanding at a CAGR of 3.80% from 2025 to 2033, according to Renub Research estimates. This steady growth reflects Europe’s deep-rooted coffee culture combined with evolving consumer preferences toward premiumization, sustainability, and convenience.

Download Free Sample Report

Coffee, a brewed beverage derived from roasted coffee beans, holds a central place in European daily life. From the bustling espresso bars of Italy to specialty cafés in France and filter coffee traditions in Germany, coffee is not merely a beverage—it is a cultural ritual. Varieties such as espresso, cappuccino, latte, and flat white are consumed across homes, cafés, and workplaces, reinforcing coffee’s position as one of Europe’s most consumed beverages.

In recent years, the rise of third-wave coffee culture, growth of artisanal roasters, and increased focus on ethical sourcing have reshaped the market landscape. Europe also remains one of the world’s largest coffee-consuming regions, accounting for a significant share of global demand.

Europe Coffee Market Size and Growth Outlook

The European coffee industry continues to mature while adapting to premium trends and regulatory shifts. Growth is driven by:

Increasing coffee consumption per capita

Rising demand for specialty, organic, and single-origin coffee

Expansion of home brewing and premium coffee machines

Strong café culture across Western and Northern Europe

Growing awareness of sustainable and ethical sourcing

While growth is moderate compared to emerging regions, Europe’s high-value consumption model ensures stable long-term revenue expansion.

Key Drivers of Growth in the Europe Coffee Market

Surging Demand for Specialty and Premium Coffee

One of the strongest drivers in the European coffee market is the growing preference for specialty and premium coffee. Consumers increasingly seek superior quality, traceable origins, and distinctive flavor profiles. The third-wave coffee movement has elevated coffee from a commodity to an artisanal product.

Independent roasters and specialty cafés are flourishing, particularly in Western Europe, offering single-origin beans, small-batch roasting, and ethically sourced products. Europe accounted for approximately 31% of global coffee consumption, making it a dominant force in shaping global coffee trends.

Premiumization allows companies to command higher margins, offsetting rising raw material and logistics costs while strengthening brand loyalty.

Rising Popularity of At-Home Coffee Consumption

Home brewing has emerged as a significant growth factor in recent years. Consumers are increasingly investing in espresso machines, grinders, and brewing accessories to recreate café-style experiences at home. This shift accelerated during the COVID-19 pandemic and has since become a long-term behavioral change.

Coffee pods, capsules, whole beans, and ground coffee tailored for home use have seen robust demand. Europe’s per capita coffee consumption remains among the highest globally, with countries like Luxembourg and Finland leading daily coffee intake.

Manufacturers are responding with innovative formats, premium blends, and subscription-based offerings to capture this growing home-consumption segment.

Growing Focus on Sustainability and Ethical Sourcing

European consumers are placing increasing importance on sustainability, traceability, and ethical sourcing. Certifications such as Fair Trade, Rainforest Alliance, and organic labeling significantly influence purchasing decisions.

Additionally, the EU Deforestation Regulation (EUDR) requires coffee importers to ensure their supply chains are free from deforestation. This regulation is reshaping sourcing strategies, pushing companies to adopt advanced traceability systems and strengthen relationships with certified farms.

Brands that demonstrate environmental responsibility and social impact are gaining a competitive edge, particularly among younger and environmentally conscious consumers.

Challenges in the Europe Coffee Market

Price Volatility and Supply Chain Disruptions

Coffee prices remain highly volatile due to climate change, unpredictable weather patterns, and geopolitical tensions in producing regions. Coffee yields are sensitive to temperature shifts and rainfall variability, directly affecting supply and cost structures.

Increased transportation costs, labor shortages, and logistical disruptions further strain the supply chain. These factors often lead to higher retail prices, creating pressure on both manufacturers and consumers.

Rising Competition from Alternative Beverages

The European beverage market is witnessing increased competition from tea, energy drinks, plant-based beverages, and functional drinks. Health-conscious consumers, particularly younger demographics, are exploring alternatives such as matcha, kombucha, and herbal infusions.

Additionally, growing awareness of caffeine intake has driven interest in decaffeinated and low-caffeine beverages. Coffee brands must continue innovating with functional coffee, cold brews, and plant-based formulations to maintain relevance.

Europe Coffee Market by Product Type

Europe Whole Bean Coffee Market

Whole bean coffee is gaining popularity as consumers prioritize freshness and flavor quality. Coffee enthusiasts prefer grinding beans at home to preserve aroma and taste. Rising ownership of home espresso machines and grinders has significantly boosted this segment.

Specialty roasters are expanding offerings of organic, single-origin whole beans, particularly in Germany, France, and Italy, where coffee culture is deeply embedded.

Europe Instant Coffee Market

Despite premiumization trends, instant coffee remains a staple in several European countries, especially in Eastern Europe and the United Kingdom. Its affordability, convenience, and long shelf life make it appealing to busy professionals and older consumers.

Innovation in freeze-dried and premium instant coffee has improved taste and quality, allowing the segment to retain its relevance amid growing competition.

Europe Coffee Market by Distribution Channel

Supermarkets and Hypermarkets

Supermarkets and hypermarkets dominate coffee retail sales across Europe. They offer extensive product variety, competitive pricing, and convenient access. Private-label coffee brands are expanding rapidly, catering to both budget-conscious and premium consumers.

Retailers are also increasing shelf space for organic and ethically sourced coffee, supported by in-store promotions and loyalty programs.

Specialist Coffee Retailers

Specialist retailers play a critical role in driving premium coffee adoption. These outlets focus on high-quality beans, brewing equipment, and customer education. Independent roasters and boutique cafés thrive in urban areas, appealing to consumers seeking authenticity and craftsmanship.

Direct trade practices and sustainability narratives further strengthen consumer trust and brand differentiation in this segment.

Country-Level Insights

United Kingdom Coffee Market

The UK coffee market is characterized by strong demand for café-style beverages, instant coffee, and premium home brewing products. Specialty chains, independent cafés, and subscription-based coffee services are expanding rapidly. Ethical sourcing and convenience remain key purchase drivers.

Germany Coffee Market

Germany is one of Europe’s largest coffee consumers, with strong demand for filter coffee and whole beans. Supermarkets and discounters play a major role, while specialty roasters cater to premium segments. Organic and fair-trade coffee continues to influence purchasing behavior.

Italy Coffee Market

Italy’s coffee market is deeply rooted in espresso culture. Traditional espresso bars dominate, but demand for specialty and single-origin coffee is rising. Home espresso machine adoption is also increasing, particularly among younger consumers exploring global coffee trends.

France Coffee Market

France has a mature coffee culture with growing interest in specialty, organic, and fair-trade coffee. Third-wave cafés and independent roasters are shaping consumer preferences, while home brewing continues to gain momentum.

Europe Coffee Market Segmentation

By Product Type

Whole Bean

Ground Coffee

Instant Coffee

Coffee Pods and Capsules

By Distribution Channel

On-Trade

Off-Trade

Supermarkets/Hypermarkets

Convenience Stores

Specialist Retailers

Other Off-Trade Channels

By Country

United Kingdom

Germany

France

Russia

Italy

Spain

Rest of Europe

Competitive Landscape and Company Analysis

The Europe coffee market is highly competitive, featuring global giants and strong regional players. Key companies are evaluated across four dimensions: company overview, recent developments and strategies, product portfolio and launches, and revenue performance.

Major Players Include:

JAB Holding Company

Nestlé SA

The Kraft Heinz Company

J.J. Darboven GmbH & Co. KG

Strauss Group Ltd

Melitta Group

Starbucks Corporation

Krüger GmbH & Co. KG

Luigi Lavazza SpA

Maxingvest AG (Tchibo)

These companies are focusing on premium product launches, sustainability initiatives, digital engagement, and expansion of specialty offerings to strengthen market positioning.

Final Thoughts

The Europe Coffee Market remains resilient and culturally entrenched, balancing tradition with innovation. While growth is moderate, the market’s value expansion is supported by premiumization, sustainability initiatives, and evolving consumption habits.

As consumers continue to seek quality, authenticity, and ethical sourcing, coffee brands that align with these values will be best positioned to thrive. With steady demand across households, cafés, and retail channels, Europe’s coffee industry is set to remain a cornerstone of the global coffee economy through 2033.