How Los Angeles’ Richest Man’s Fortune Turned Into Debt

New Delhi:

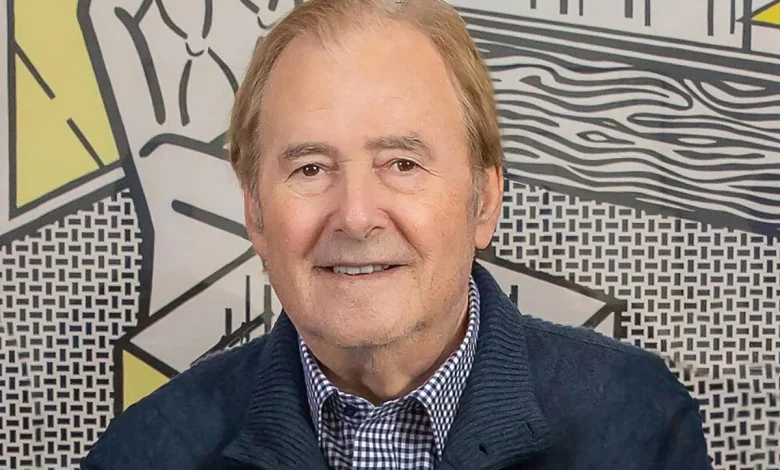

Gary Winnick, once ranked the wealthiest man in Los Angeles, built a reputation for extraordinary affluence during the dot-com boom. But court filings and lender actions following his death have revealed a sharply contrasting financial reality, according to a report in The Wall Street Journal.

Winnick, who died at the age of 76 in November 2023, amassed an estimated $6.2 billion fortune at the height of the late-1990s telecom surge. He was the founder of Global Crossing, a company that set out to build a worldwide undersea fibre-optic network and briefly propelled him into the ranks of America’s richest individuals. The Los Angeles Business Journal once placed him at the top of its local wealth rankings.

During that period, Winnick became known for his philanthropy and political connections, donating millions to institutions such as the Los Angeles Zoo and maintaining close ties with former US President Bill Clinton. His wealth allowed him to acquire Casa Encantada, a landmark Bel-Air estate bought in 2000 for $94 million, then the most expensive home sale in US history. Additional properties included a Malibu beach house and a New York apartment.

“He’s so rich that his longtime housekeeper, to whom he gave stock in a company he was starting, is now a millionaire herself,” the Los Angeles Times said in 1999.

But legal disputes that emerged after Winnick’s death have shown that many of his assets were pledged against large loans. His widow, Karen Winnick, has stated in court documents that she was unaware of the extent of the borrowing or the financial strain he faced.

“Gary managed our household finances. I was unaware that, in the years prior to his death, he faced significant financial demands. I did not know, until Gary passed away, that we were overextended and that Gary needed money to repay debts and maintain his lifestyle,” Karen wrote in the court documents, according to WSJ.

Winnick took a $100-million revolving loan from real estate investment firm CIM Group in 2020. The loan was secured against Casa Encantada, the Malibu home and personal assets. After missed payments, the debt grew to $155 million.

The borrowing came after decades of high-risk financial activity. Winnick began his career in the 1970s and 1980s at Drexel Burnham Lambert.

Global Crossing collapsed in 2002 when demand for telecom capacity fell short of expectations. Winnick sold about $730 million worth of shares before the collapse and later paid $55 million to settle shareholder lawsuits over alleged misleading disclosures.

Despite the company’s failure, Winnick’s lifestyle appeared unchanged. He remained active in philanthropy, social circles and private investments, backing ventures across technology and media.

In his later years, Winnick became entangled in expensive legal disputes. These included litigation linked to the concert-streaming company Qello and a separate case involving spectrum licences. Legal costs and loan repayments added to the financial strain.

In June 2023, the Winnicks put Casa Encantada on the market for $250 million. Winnick died months later. His estate later acknowledged insolvency during mediation, according to WSJ.

In September 2025, CIM moved to foreclose on Casa Encantada and the Malibu property. Karen accused the lender of running a “loan-to-own scheme” that would leave her “effectively destitute,” CIM dismissed the claims as “fantastical.”

An auction scheduled for this week was stopped at the last minute after an appeals court judge granted an emergency stay.