CPI Inflation Rate: Understanding How It Shapes Everyday Life

When people talk about the economy, one term often pops up in the news: CPI inflation rate. It might sound technical, but this simple measure affects everything from the price of your morning coffee to how far your paycheck stretches each month. Understanding what CPI is—and how it connects to inflation—can help you make smarter financial decisions and better understand the world around you.

What Is the CPI Inflation Rate?

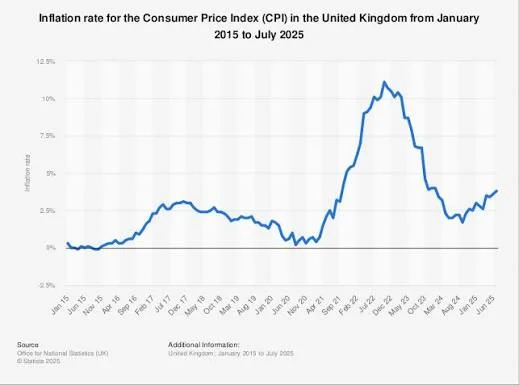

The Consumer Price Index (CPI) is a way to measure how much prices for everyday goods and services are rising or falling over time. Government agencies, like the U.S. Bureau of Labor Statistics (or the Office for National Statistics in the UK), collect data on thousands of products—such as groceries, rent, fuel, and clothing—to track how their prices change month by month.

The CPI inflation rate is the percentage change in the Consumer Price Index compared to the previous year. If the CPI inflation rate is 3%, that means, on average, prices are 3% higher than they were 12 months ago. While that might not sound like much, over time, it adds up—and affects everyone.

Why Inflation Happens

Inflation occurs when the overall price level of goods and services increases. It can happen for many reasons. One common cause is demand-pull inflation, which occurs when people are spending more money than the economy can produce—so prices rise due to high demand. Another cause is cost-push inflation, which happens when the cost of making goods (like wages or raw materials) goes up, forcing companies to charge more.

Sometimes, inflation can also be influenced by global factors, such as oil prices, international conflicts, or supply chain disruptions. The COVID-19 pandemic, for example, caused inflation to spike worldwide because factories shut down and shipping costs soared, while people still wanted to buy the same products.

Why the CPI Inflation Rate Matters

For most people, inflation is most noticeable when prices rise faster than wages. The CPI inflation rate helps governments, businesses, and citizens understand how quickly prices are changing.

Here’s why it matters:

For households: The CPI tells you how much your cost of living is increasing. If inflation rises but your salary doesn’t, your purchasing power decreases—you can buy less with the same amount of money.

For businesses: Companies use CPI data to adjust prices, plan budgets, and set employee wages.

For governments and central banks: Institutions like the Bank of England or the Federal Reserve monitor CPI closely to decide whether to raise or lower interest rates. When inflation is high, they often raise interest rates to cool down spending and borrowing.

Inflation’s Impact on Daily Life

Inflation affects nearly every part of daily life, even if we don’t always notice it. Grocery store prices rise, rent increases, and fuel becomes more expensive. People might cut back on non-essentials like eating out, new clothes, or travel.

But inflation doesn’t always have to be bad. A moderate level of inflation—around 2%—is actually considered healthy. It encourages spending and investment because people know that prices will rise slightly over time. The real problem begins when inflation rises too fast (making essentials unaffordable) or falls too low (which can lead to economic stagnation).

CPI Inflation vs. Other Measures

While CPI is one of the most widely used measures of inflation, it’s not the only one. Economists also track:

Core Inflation: This excludes volatile items like food and energy, giving a clearer view of long-term trends.

Producer Price Index (PPI): This tracks changes in prices from the perspective of producers and manufacturers, rather than consumers.

Retail Price Index (RPI): Used in some countries like the UK, this is similar to CPI but includes housing costs like mortgage interest payments.

Each of these provides a different angle on how prices behave in the economy.

The Human Side of Inflation

Behind every percentage point of inflation are real people. For families on fixed incomes, a sharp rise in prices can make it harder to afford essentials. For young professionals saving for a house, higher inflation can push property prices out of reach. Meanwhile, retirees who rely on savings might see their money lose value over time if inflation isn’t balanced by interest rates.

However, not everyone loses during inflation. People who owe money—like those with mortgages—may benefit if their loan repayments stay fixed while their income increases. Businesses can also benefit if they can raise prices faster than their costs go up.

What Can Be Done About Inflation?

Central banks play a key role in controlling inflation. When prices rise too quickly, they often raise interest rates to make borrowing more expensive and encourage saving. This slows down spending and helps stabilize prices. Conversely, when inflation is too low, they may lower interest rates to encourage investment and stimulate the economy.

Governments also use fiscal policies, such as adjusting taxes or increasing public spending, to manage economic growth and inflation.

Conclusion

The CPI inflation rate might seem like a technical number buried in economic reports, but it has a direct impact on our wallets, savings, and future plans. Understanding it helps us navigate an unpredictable world where prices and purchasing power are constantly shifting.

Whether you’re budgeting for groceries, negotiating a raise, or following the news, keeping an eye on inflation is essential. It’s not just an economic term—it’s a reflection of the rhythm of everyday life.

—