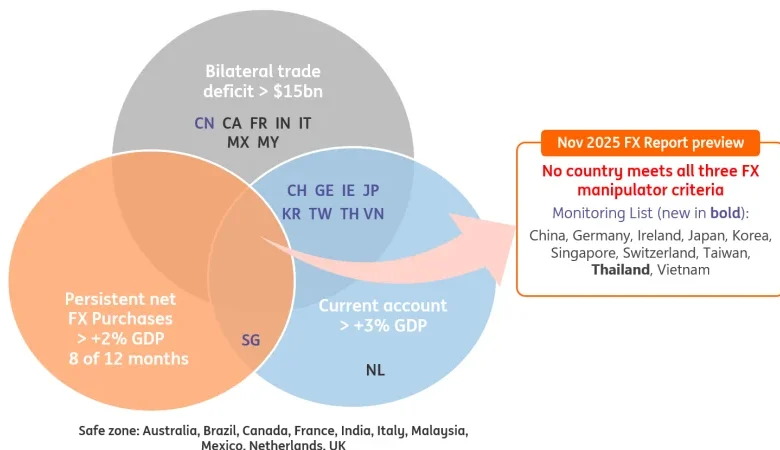

Treasury FX Report preview: Tighter scrutiny, no manipulator tags

FX practices have regained prominence in Trump’s second term. Ahead of this release, three themes stand out in our view:

1) Dollar depreciation

This Report covers a period of sharp dollar depreciation. While the 4Q rolling nature of the analysis includes the 2H24 dollar rally, it gives some initial indications of how US trading partners reacted to the weaker dollar, which is of great interest to the Treasury in its assessment of potentially unfair FX practices. This Autumn Report will be a good preview of the June 2026 edition, which will cover the whole of 2025 and will probably show higher intervention figures.

2) Recent FX joint statements

The US and some trading partners have issued joint statements on FX practices of late (table below). These are probably part of the Treasury’s intensified focus on FX practices through the lenses of tackling the large US trade deficit. At the same time, they could slightly reduce the chance of FX manipulator tags being handed out via the FX Report as the Treasury is already very active in direct FX discussions with central banks, likely based on up-to-date intervention estimates/disclosures. That said, the FX Report will provide an important update on how instrumental these joint statements are in the overall assessment of a country’s trade/FX practices.

3) Shifting approach by the Treasury

In the June 2025 FX Report, a few statements were added, remarking the shift in approach towards a higher scrutiny of trading partners’ FX practices. While admitting FX intervention had declined, the Treasury stressed “the damage done is long-lasting”, and the intent was to strengthen the analysis of trading partners’ FX practices by taking into account market dynamics. This Report can help form expectations of how important FX discussions will be for future trade deals.