Don’t cash in your chips yet, the AI boom still has a long way to run

Apple overtook Microsoft in size, to become the second-biggest company in the world, after announcing record revenue in the first quarter of FY 2025-26 of just over $US1 billion, pushing its shares to a record high of US$277, having gained around 28 per cent in six months.

Loading

Alphabet too has hit significant milestones. The Google-owner recently announced AI-driven cloud boom pushed its quarterly revenue past $US100 billion for the first time, in the first quarter of FY25-26. Shares in the owner of the ubiquitous apps, Gmail, Chrome, Gemini, and Google Meet, reached a fresh record high at $US291.59 and have rallied around 70 per cent in six months.

Chipmaker Broadcom booted Meta to become the 6th biggest company in the world and for good reason; more than 99 per cent of all internet traffic crosses at least one Broadcom computer chip.

The company has joined up with Alphabet and OpenAI to make custom computer chips for both and its shares have risen 41 per cent in six months, also buoyed by record profits. On some estimates, OpenAI’s deal with Broadcom alone could generate $10 billion in revenue by 2027, potentially scaling from $40 billion to $50 billion annually thereafter.

These US technology giants are exceptionally profitable, with robust margins, scalable business models and strong balance sheets, which could keep getting stronger in this digital age.

On 2026 estimates, Apple and Nvidia are forecast to deliver returns on equity (ROE) of around 175 per cent and 90 per cent in financial year 2025-26, respectively, while Meta, Alphabet, Microsoft and ServiceNow sit comfortably above the S&P500 average of roughly 20 per cent.

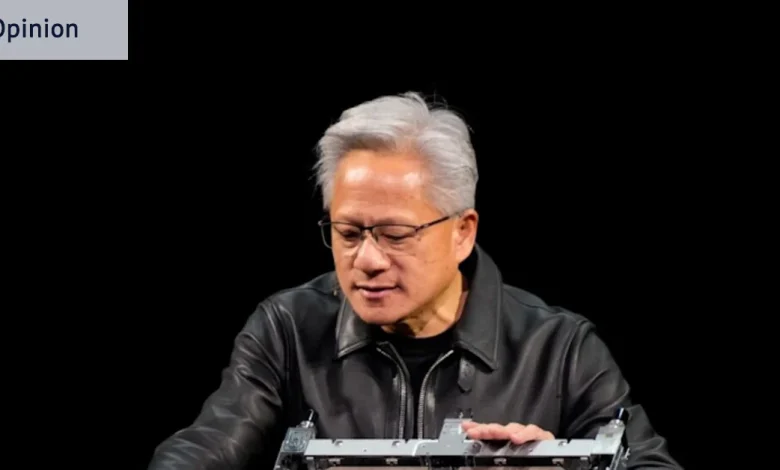

Jensen Huang, the chief executive of Nvidia.Credit: Bloomberg

Expectations for these companies’ earnings growth are similarly strong. Over the next three years, earnings per share (EPS) for the broader FANG (Facebook, Amazon, Netflix, Google) universe are projected to rise faster than the overall market, with Nvidia and Broadcom expected to compound at around 35 per cent to 40 per cent a year, while the EPS of Netflix, ServiceNow, Microsoft and Amazon are all forecast to grow in the high teens to low twenties.

This group of companies features strong structural growth prospects with consistent profitability, which is rare in global equities. Investors may be wise to consider including these tech leaders in their portfolios, as they may get bigger and more profitable over time.

Outside the US, computer chip manufacturer Taiwan Semiconductor Manufacturing Company – the world’s largest dedicated semiconductor foundry with clients including Apple, AMD, and Nvidia – is also climbing the global market capitalisation ladder quickly. TSMC is now the ninth largest company in the world after also recently overtaking Meta, with its shares up 47 per cent in six months.

Loading

Ten years ago, Nvidia, Broadcom, and TSMC, were nowhere near the world’s top 10 largest companies; now, chip companies account for at least three as the demand for computing power grows.

Australian investors still have time to ride the digital boom, and some have already caught on. Assets under management (AUM) for Global X’s FANG+ ETF have attracted near record inflows of $315 million this year on the ASX and that is set to surpass total inflows of $349 million in 2024.

With total AUM of $1.69 billion as at October 31, FANG+’s AUM could soon surpass $2 billion as investors buy into the profitability of the US tech giants in a single trade.

Billy Leung is a senior investment strategist at Global X.

- Advice given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. They should always seek their own professional advice that takes into account their personal circumstances before making any financial decisions.

Expert tips on how to save, invest and make the most of your money delivered to your inbox every Sunday. Sign up for our Real Money newsletter.